- REX-Osprey Solana + Staking ETF (SSK) launched on Cboe BZX Exchange with $33.6 million in first-day trading volume

- Solana price gained 4.6% in 24 hours, trading above $153 after the historic ETF debut

- CME Solana futures volume hit all-time highs, showing increased institutional interest

- Technical analysis suggests potential breakout with targets ranging from $180 to $500

- DeFi Development Corp announced $100 million convertible note offering to build SOL treasury holdings

Solana launched its first-ever staking ETF in the United States on Wednesday, marking a historic milestone for the cryptocurrency. The REX-Osprey Solana + Staking ETF trades under the ticker SSK on the Cboe BZX Exchange.

The new ETF generated strong initial demand. Trading volume reached $33.6 million on the first day with $12 million in net inflows. The fund saw $8 million in trading volume within just the first 20 minutes of launch.

Nathan McCauley, CEO and co-founder of Anchorage Digital, serves as the ETFs custodian and staking partner. He stated that the launch represents a win for consumers and a step toward full access to the crypto ecosystem.

The staking ETF differs from regular spot crypto ETFs by providing direct exposure to Solana plus additional yield through staking rewards. This structure is set up under the Investment Company Act of 1940, requiring a qualified custodian to retain and stake the funds assets.

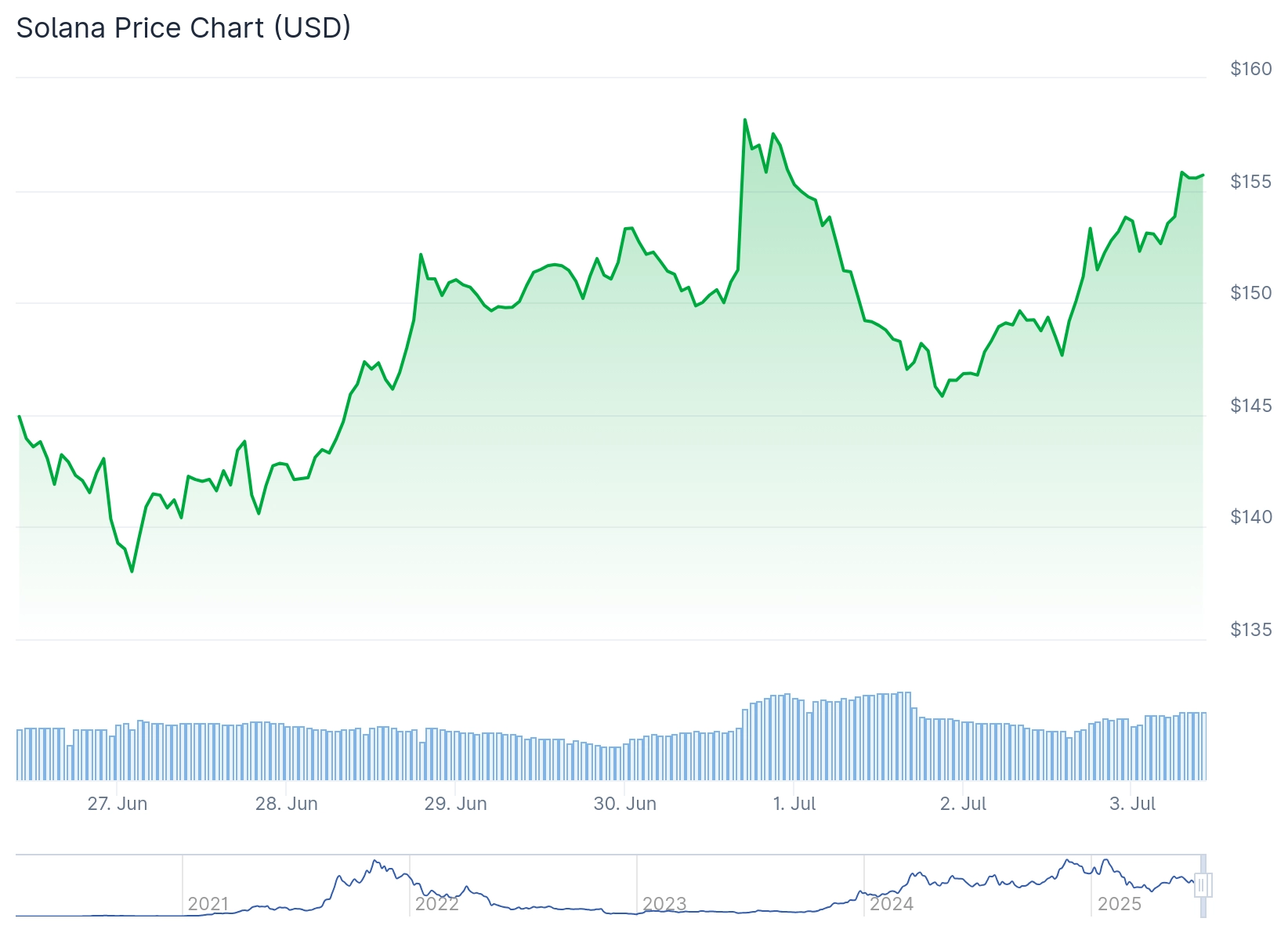

Solanas price responded positively to the ETF launch. SOL traded above $153, gaining 4.6% in the last 24 hours. The cryptocurrency is currently trading above its 50-day Exponential Moving Average with the Relative Strength Index moving upward over the midline.

Source: CoinGecko

Source: CoinGecko

Technical analysis shows several key resistance levels ahead. The 100-day EMA sits at $154, while the 200-day EMA is at $159. The main breakthrough target is $187, which was the May high.

Institutional activity in Solana futures markets has reached record levels. CME Solana futures volume hit an all-time high, with average open interest in SOL futures approaching $7 billion.

Bloomberg analysts Eric Balchunas and James Seyffart have raised their probability of spot Solana ETF acceptance to 95% by the end of 2025. This suggests the current staking ETF may be just the beginning of broader institutional adoption.

DeFi Development Corp announced a $100 million private convertible note offering primarily intended to build SOL holdings as part of its corporate treasury strategy. The convertible senior note, due in 2030, includes an option for an additional $25 million, potentially bringing the total to $125 million.

This move reflects growing corporate confidence in Solanas long-term value proposition. It mirrors treasury strategies previously adopted by major companies for Bitcoin.

Technical Indicators Point to Potential Breakout

Since mid-2022, Solana has respected an important ascending trendline that has remained intact. Every major correction has found support along this line. The latest bounce off $144 support demonstrates this bullish pattern remains viable.

The Bollinger Bands are tightening around current price levels. When this occurs, it often leads to strong moves in either direction. If SOL holds above the 20-day Simple Moving Average and expands out of this tight range, the next targets would be $158 and $173 levels from recent highs.

Extended targets based on ascending trendline analysis range from $220 to $300. More aggressive projections suggest potential moves toward the $470 to $500 range if current bullish momentum and market structure hold.

Solanas network fundamentals continue showing strength. The blockchain has topped real economic value rankings since October 2024, reaching $551 million in January 2025. The network has maintained over 15 months of continuous uptime with daily transactions consistently exceeding 160 million.

The Alpenglow consensus code currently being tested aims to achieve finality of 100-150 milliseconds while reducing breakeven capital for validators to approximately $75,000. This would make the network even more competitive.

Conservative price targets range from $180 to $220 if momentum continues above key moving averages. Aggressive projections suggest $300 to $500 based on ascending trendline analysis and institutional adoption patterns.

Support levels to watch include $150 at the 50-day EMA, $144, and $125 if profit-taking accelerates. The ETF launch success, institutional interest, and technical setup all point to potential upside for Solana.