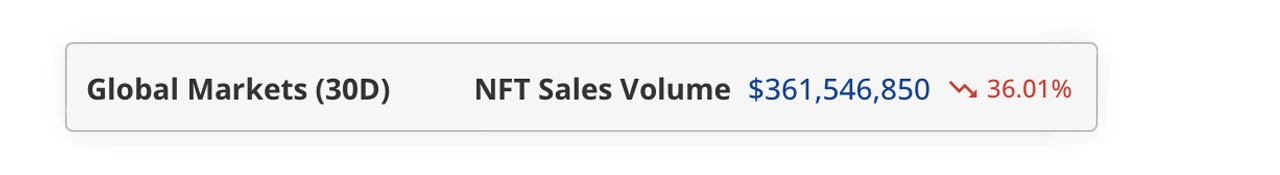

After a downtrodden September, non-fungible token (NFT) sales dropped further in October, totaling $361 million—a 36% decrease.

NFT Sales Fall 36% in October, Totaling $361 Million

NFT sales in October didn’t quite bounce back, showing a 36% decline after September’s 47.9% dip. The month saw around $361.5 million in sales, with Ethereum NFTs holding the lead. Ether-based NFTs brought in over $120 million, a 34.11% slide from September. Bitcoin NFTs followed, reaching $69.6 million in sales, though this too marked a 27.17% dip. Solana secured the third spot, logging $66.26 million—down 22.94% from September.

October’s NFT sales volume from cryptoslam.io.

October’s NFT sales volume from cryptoslam.io.

October’s leading digital collectible was Mythos’ Dmarket, soaring with $37.1 million in sales, marking a significant 3,186.16% rise from September. Meanwhile, Immutable X’s Guild of Guardians recorded $13.17 million, a gentle 5.58% dip. The Bitcoin Puppets NFT collection grabbed $10.58 million, reflecting a solid 66.78% increase. Wrapping up the top five, Bored Ape Yacht Club (BAYC) brought in $10.49 million, while Cryptopunks followed closely at $10.18 million.

The priciest NFT sale in October was an Uncategorized Ordinal, which fetched $4.55 million roughly 16 days ago. Additionally, Ethereum witnessed BAYC #7,940 sell for $1.43 million, a Locked USDT collectible on BNB went for $343,310, and a Polygon Mining Pass brought in $205,145. October logged about 7.43 million NFT transactions, a 40.55% drop. Sellers rose by 2.23%, and buyers climbed by 26.52%, according to cryptoslam.io data.

October’s NFT market data points to a softening interest in digital collectibles, with transaction volumes and sales continuing to slide. Still, buyer activity showed signs of cautious optimism, potentially signaling a floor in the market. While collections like Mythos’ Dmarket experienced notable growth, the market’s overall trend hints at a base of interested buyers—leaving room for possible stability if interest strengthens across platforms and assets.