- Mt. Gox has begun distributing Bitcoin and Bitcoin Cash to its creditors.

- Payments follow a 10-year delay due to the 2014 hack, with some still having to wait up to 90 days.

- The repayments caused widespread fear and a sell-off with BTC dropping, but analysts say it’s a buying opportunity.

And it begins – now defunct crypto exchange Mt. Gox has started distributing Bitcoin and Bitcoin Cash to its creditors as of Friday, based on an announcement from the exchange’s Rehabilitation Trustee.

Related: Crypto Banter Sees Silver Lining in Bitcoin Dip, Suggests Potential for Market Rebound

These repayments are being processed through specific cryptocurrency exchanges, including Bitbank and SBI.

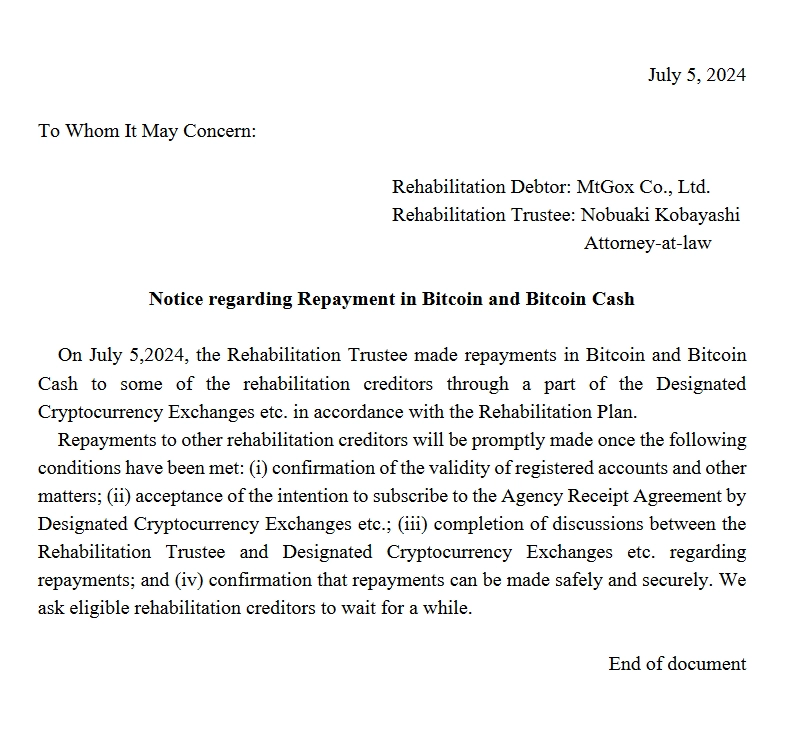

On July 5, 2024, the Rehabilitation Trustee made repayments in Bitcoin and Bitcoin Cash to some of the rehabilitation creditors through a part of the Designated Cryptocurrency Exchanges etc. in accordance with the Rehabilitation Plan.

Mt. Gox

Mt. Gox

After a 10-year wait since the 2014 hack – which saw up to 740,000 BTC stolen – the saga is slowly coming to an end. Although not everyone will have access to their funds immediately. The former Mt. Gox CEO Mark Karpeles told CoinDesk that customers may have to wait up to 60-90 days to receive their funds.

Advertisement

Mt. Gox confirms creditor repayments in Bitcoin and Bitcoin Cash

Mt. Gox confirms creditor repayments in Bitcoin and Bitcoin Cash

Fear-and-Greed Index Drops to Lowest in 2024

The market has not taken the sell-off lightly – as reported yesterday, mainly new investors have been selling their BTC stash. The Fear-and-Greed Index meanwhile dropped to 37, entering fear territory for the first time this year.

CMC Crypto Fear & Greed Index, source: CoinMarketCap

CMC Crypto Fear & Greed Index, source: CoinMarketCap

Analytics platform Santiment said in a post that markets “have continued to bleed, and social media is now showing historic levels of FUD”.

There have been numerous occasions in the past 24 hours where mentions of “sell” have outnumbered “buy” in crypto forums, marking the highest ratio of negative to positive comments seen in 2024. Despite this, some aggressive traders view this as an opportunity to adopt a contrarian approach and buy in response to the widespread negativity, they added.

30% of Bitcoin Hasn’t Moved for 5 Years

While BTC seems to be stabilising around US$56,304 (AU$83,444), the sell-off wiped millions of long positions and liquidated more than 150K traders.

Bitcoin (BTC), 7-day graph, source: CoinMarketCap

Bitcoin (BTC), 7-day graph, source: CoinMarketCap

Meanwhile, data from IntoTheBlock shows that over 30% of all Bitcoin has not been moved for more than five years, reflecting strong confidence among long-term holders. The fact that these coins have remained static through various price changes indicates that many investors see Bitcoin as a reliable store of value.

With this, investors still in doubt could look at crypto analyst Miles Deutscher’s most recent take on the market.

He wrote in a post that, while short-term obstacles like Mt. Gox and Germany’s selling remain, in the long term there are the BTC and ETH ETFs, US elections, a potential shift in policies, and the massive FTX payout.

Related: Hamster Kombat Reaches Massive 239 Million Users in Just 80 Days

The US$16 billion (AU$23.7 billion) FTX payout to customers is a positive signal because it likely restores some degree of investor confidence and liquidity. The injection not only potentially stabilises but could also boost market sentiment as those customers regain capital that might be reinvested into the market.