According to historical data, Cardano (ADA) may be approaching overvalued territory. This comes after an impressive 180% price increase over the last 30 days.

For some investors, the timing might seem premature, especially with the much-anticipated altcoin season just beginning. However, on-chain indicators suggest that ADA might face a correction before establishing new highs.

Cardano Metrics Flash Bearish Signs

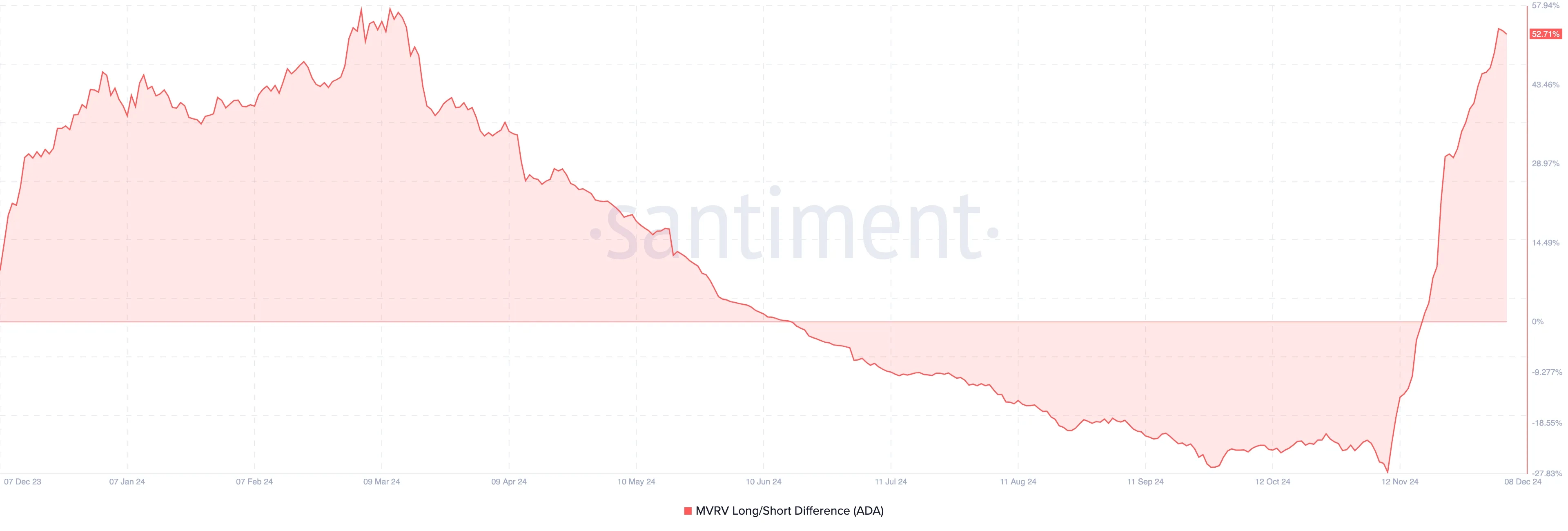

One key metric suggesting that Cardano could soon be overvalued is the Market Value to Realized Value (MVRV) Long/Short Difference. The MVRV Long/Short Difference checks if long-term holders have more unrealized profits at the current price or if short-term holders do.

When the metric increases, it means long-term holders have made more gains. On the other hand, if it decreases or falls to the negative region, it means short-term holders have the upper hand.

This difference can also help spot when a cryptocurrency is undervalued or overvalued. Looking at historical data, Cardano’s price hit an overvalued point when the MVRV Long/Short difference hit 57.94% in March.

Cardano Market Value to Realized Value Long/Short Difference. Source: Santiment

Cardano Market Value to Realized Value Long/Short Difference. Source: Santiment

As seen above, the metric’s reading has hit 52.71%, suggesting that ADA could be close to being overvalued again. If validated, then the altcoin’s price might undergo a notable correction.

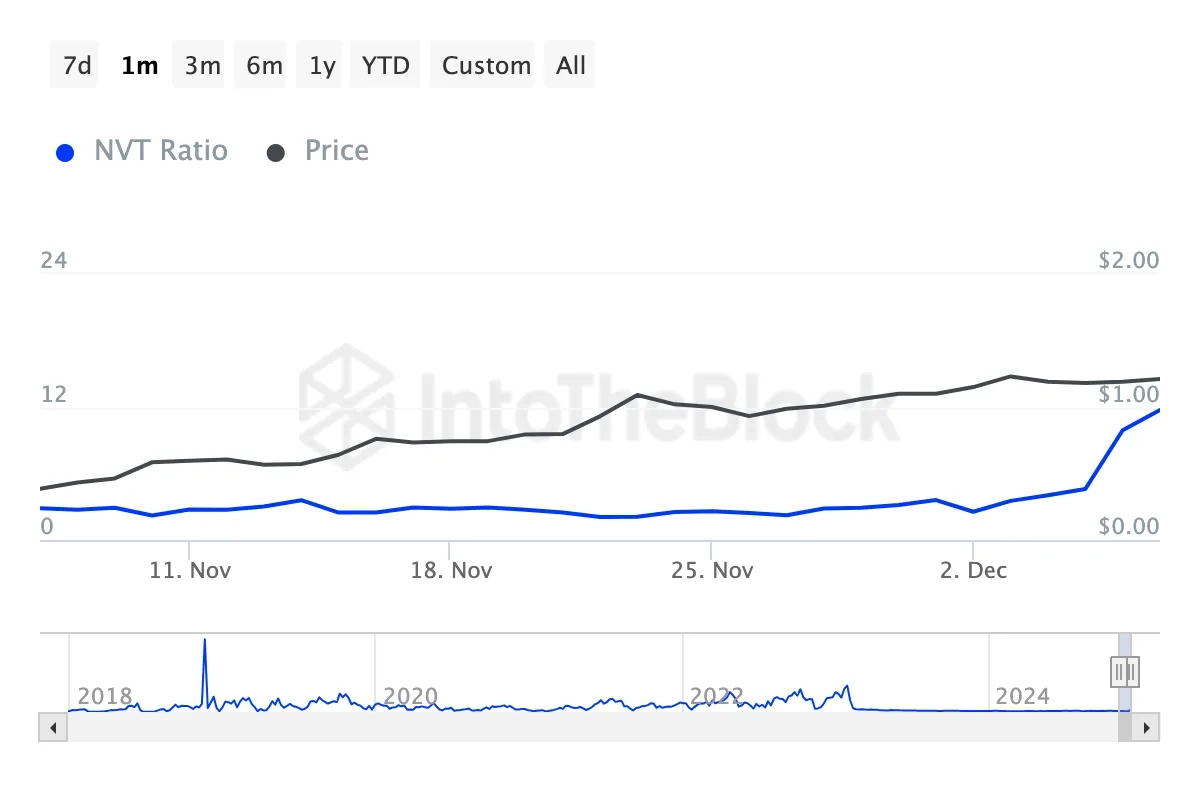

Apart from this, IntoTheBlock data shows a spike in the Network Value to Transaction (NVT) ratio. The NVT ratio is a metric used to assess a cryptocurrency’s valuation relative to the value being transmitted on the network.

When the ratio drops, it means that transaction volume has outpaced market cap growth, indicating that the token is undervalued. On the other hand, a rise in the NVT ratio, as it is currently, indicates that Cardano’s market cap has grown faster than the value transacted. If this remains the case, the ADA might be tagged overpriced, and the value might decrease.

Cardano Network Value to Transaction (NVT) Ratio. Source: IntoTheBlock

Cardano Network Value to Transaction (NVT) Ratio. Source: IntoTheBlock

ADA Price Prediction: Lower Than $1

From a technical perspective, the daily chart shows that the Bollinger Bands (BB) has expanded. This notable expansion indicates high volatility around ADA, suggesting that price swings in the coming days could be massive.

But besides that, the upper band of the BB tapped ADA’s price at $1.30. When the upper band of the indicator hits the price, it means it is overbought. On the other hand, when the lower band does that, it indicates an oversold status.

Cardano Daily Analysis. Source: TradingView

Cardano Daily Analysis. Source: TradingView

Therefore, it appears that the Cardano token is overbought. Considering this condition, then Cardano’s price could decrease to $0.92. On the flip side, if buying pressure increases, this might not happen as ADA could rise above $1.40.

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.