Unlike the prior period, crypto investment products ended last week with a net positive flow. However, Binance Coin (BNB) did not share the same trend.

This development raises concerns about the coin’s short-term potential. Will BNB’s price falter as a result?

Binance Coin Lags Behind the Top Cryptos

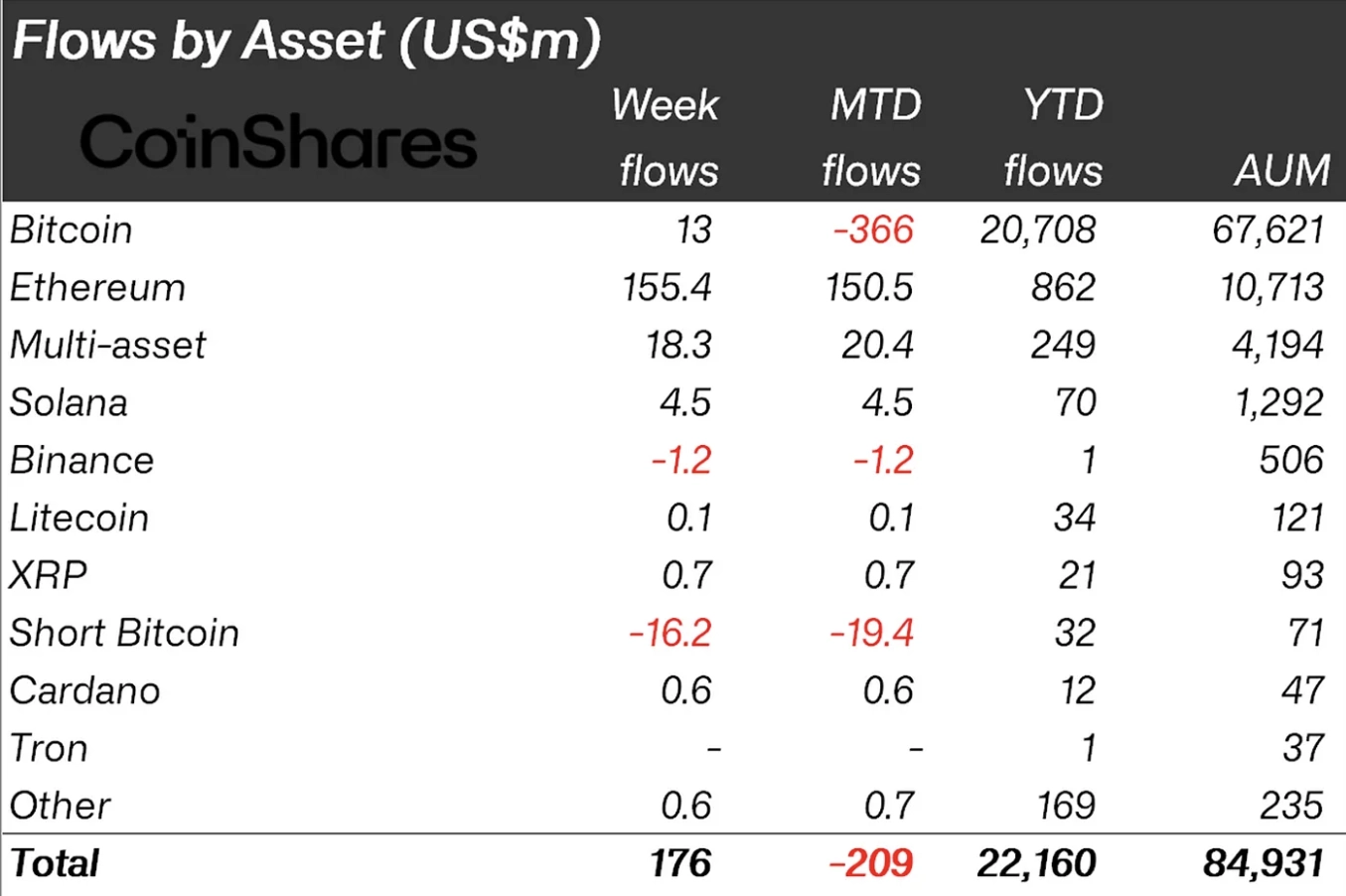

According to CoinShares’ latest report, digital asset investment products saw inflows worth $176 million. This increase suggests that investors saw last Monday’s crash as an opportunity to accumulate at discount prices.

While Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) saw notable inflows, BNB was the only top-5 coin to experience an outflow. Specifically, Binance Coin recorded outflows totaling $1.2 million.

This decline could be linked to BNB’s price action. During the flash crash, the coin’s value dropped to $404.30, causing panic among investors and spreading doubt about the cryptocurrency’s potential.

Read more: How To Buy BNB and Everything You Need To Know

Sponsored

Earn up to 0.05 BTC per month with free YouHodler cloud miner with 3 easy steps:

- Create account on YouHodler: the basic miner level offers rewards for simply signing up

- Mine Bitcoin without CPU usager: Youhodler Cloud Miner operates without using any computing power from your device

- Play and earn real Bitcoin: the gamified approach of Cloud Miner makes mining enjoyable

Sponsored

Digital Asset Fund Flows. Source: CoinShares

Digital Asset Fund Flows. Source: CoinShares

This sentiment contrasts sharply with the optimism seen when BNB reached $701 in June. Currently, the altcoin trades at $508, marking a 5.06% decrease from its recent peak of $535 on August 11.

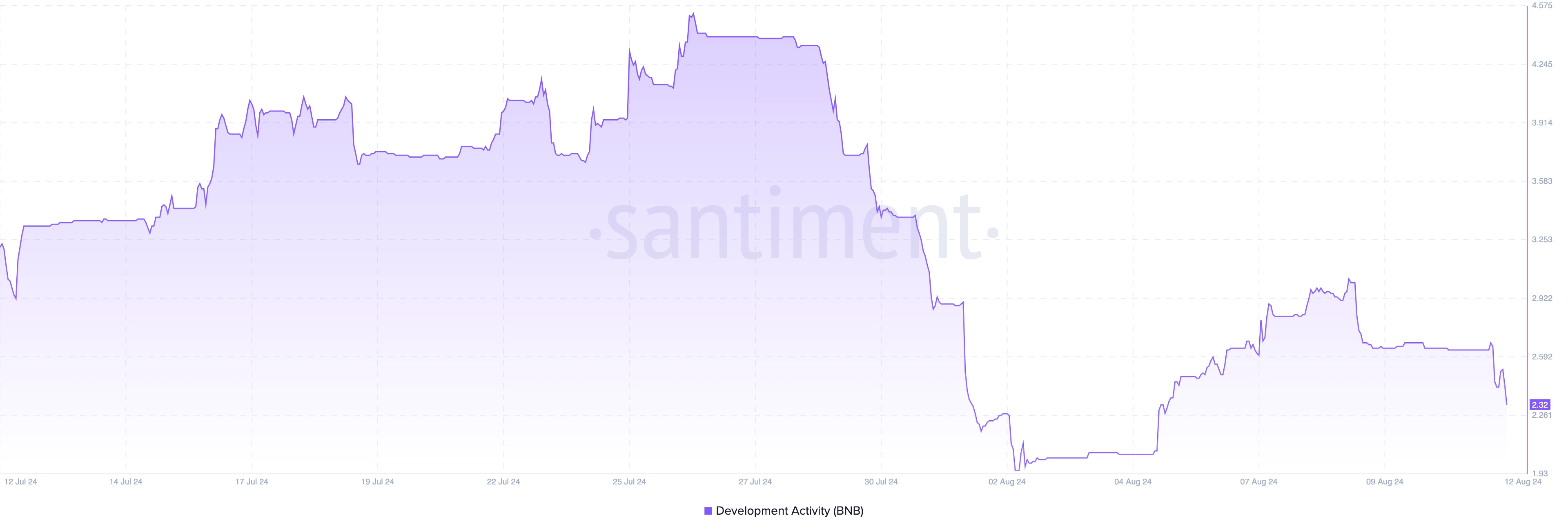

In addition to the price decrease, the BNB ecosystem is experiencing a significant decline in development activity, a key metric for assessing a blockchain’s health and valuation.

This metric indicates whether a project is experiencing growth and smart contract deployment. An increase in development activity suggests that developers are rolling out new features, which can potentially drive user adoption of the blockchain.

Binance Coin Development Activity. Source: Santiment

Binance Coin Development Activity. Source: Santiment

The decrease in BNB Chain’s development activity indicates that code commits aimed at improving the network are lower than usual. It suggests a bearish signal and could negatively impact BNB’s price if the trend continues.

BNB Price Prediction: $479 Breakdown In Sight

According to the Bull Bear Power (BBP), bears still dictate the direction in which BNB heads. Also known as the Elder Force Index, the BBP measures the strength of buyers and sellers by comparing the swing low and swing high to the Exponential Moving Average (EMA).

When the BBP reading is positive, bulls are in control, and the price may increase. The negative reading implies that BNB’s price will likely decrease.

Additionally, the coin’s price is below the 20-day EMA, as it was some weeks back. Put simply, the EMA measures trend direction over a period of time. If the price is above the indicator, the trend is bullish.

Read more: Binance Coin (BNB) Price Prediction 2024/2025/2030

Binance Coin Daily Analysis. Source: TradingView

Binance Coin Daily Analysis. Source: TradingView

Thus, the current position means that BNB is undergoing a bearish trend. Suppose this remains the same; BNB’s price may decrease to $479.10. However, if bulls retrieve dominance from bears, the value of the coin may jump to $526.

Trusted

Disclaimer

In line with the Trust Project guidelines, this price analysis article is for informational purposes only and should not be considered financial or investment advice. BeInCrypto is committed to accurate, unbiased reporting, but market conditions are subject to change without notice. Always conduct your own research and consult with a professional before making any financial decisions. Please note that our Terms and Conditions, Privacy Policy, and Disclaimers have been updated.