Gain Valuable Market Insights by Exploring the Sample Report :https://www.maximizemarketresearch.com/request-sample/25027/

Market Definition & Estimation

The mining equipment market includes all machinery and systems used in extracting geological materials from the Earth. This comprises drilling equipment, excavators, haul trucks, crushers, screeners, conveying systems, and mineral processing machinery. The market covers a broad spectrum of applications including surface and underground mining of metals, coal, and industrial minerals.

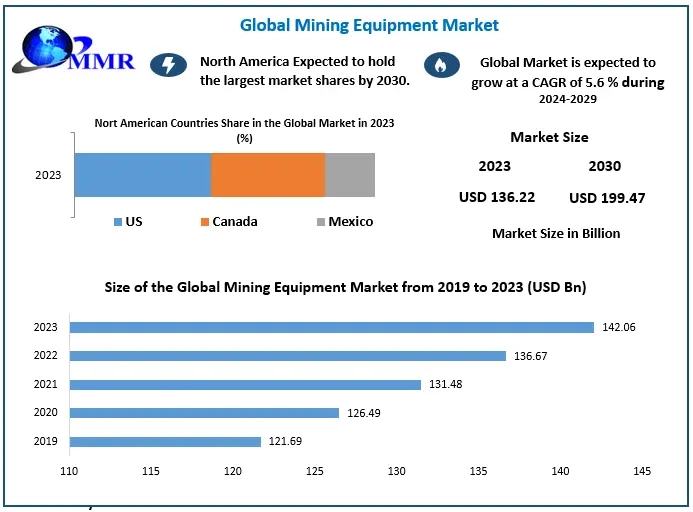

In 2023, the market was valued at USD 136.22 billion and is expected to grow to USD 199.47 billion by 2030, signaling robust demand from both developing and developed regions. The markets sustained growth is supported by the global infrastructure boom, the expansion of electric vehicles, and the increasing complexity of mining operations.

Market Growth Drivers & Opportunities

Increasing Demand for Critical Minerals

The rapid growth of the electric vehicle, renewable energy, and electronics sectors is fueling the demand for critical minerals such as lithium, cobalt, and rare earth elements. As nations invest in clean energy transitions, mining operations are expanding to ensure adequate supply of these raw materials, stimulating equipment demand.

Technological Advancements and Automation

Modern mining operations are increasingly embracing automation and digital solutions to improve productivity, safety, and operational efficiency. From autonomous haulage systems to remotely operated drills and loaders, mining companies are shifting toward equipment that integrates Artificial Intelligence (AI), IoT (Internet of Things), and real-time monitoring.

Focus on Environmental Sustainability

Governments and companies alike are implementing stricter environmental regulations to minimize emissions and ecological footprints. As a result, mining companies are investing in electric and hybrid equipment, dust suppression systems, and energy-efficient machinescreating strong demand for sustainable mining equipment.

Growing Urbanization and Infrastructure Projects

Urbanization in Asia-Pacific, Latin America, and Africa continues to push demand for cement, metals, and other raw materials. To meet these needs, mining companies are expanding operations, especially in remote areas, leading to increased procurement of high-performance surface and underground mining machinery.

Predictive Maintenance and Lifecycle Services

OEMs and mining contractors are increasingly focusing on equipment lifecycle value. The use of data analytics for predictive maintenance has emerged as a critical differentiator. This enhances equipment uptime, reduces unplanned downtime, and provides a recurring revenue stream for equipment manufacturers.

Descriptive Segmentation Analysis

By Equipment Type

-

Mining Drills & Breakers: These machines are fundamental to ore fragmentation. The category includes rotary drills, jackhammers, and down-the-hole drills, especially useful in both surface and underground operations.

-

Crushing, Pulverizing & Screening Equipment: This segment includes jaw crushers, cone crushers, and vibrating screens used for reducing ore size and preparing materials for further processing. As ore grades decline, demand for advanced crushing solutions rises.

-

Surface Mining Equipment: Dominant in open-pit operations, this includes haul trucks, draglines, loaders, and bulldozers. They are valued for handling large volumes of material over expansive areas.

-

Underground Mining Equipment: With ore bodies moving deeper, equipment like continuous miners, shuttle cars, and longwall systems are gaining traction, particularly in regions with established underground mines.

-

Mineral Processing Equipment: Includes flotation cells, magnetic separators, spiral concentrators, and gravity separation units. Increasing attention to yield optimization and ore beneficiation is driving adoption.

By Propulsion Type

-

Diesel-Powered Equipment: Diesel remains the most widely used propulsion system in mining due to its high power output and adaptability in remote locations. However, it is gradually being challenged by cleaner alternatives.

-

Electric and Hybrid Equipment: These are gaining popularity in underground mining due to strict emission norms. Technological improvements are enhancing the capabilities of electric drives and battery-operated machines.

By Application

-

Metal Mining: This segment dominates the market due to high global demand for copper, gold, zinc, iron ore, and rare earth metals. Increased exploration and production activities are bolstering demand for heavy machinery.

-

Coal Mining: Although coal demand is declining in some developed regions, it continues to be a crucial energy source in Asia-Pacific and parts of Africa, supporting demand for specialized equipment.

-

Mineral Mining: Equipment for mining potash, limestone, phosphate, and gypsum is also seeing steady demand, particularly from fertilizer, cement, and construction industries.

By Mining Type

-

Surface Mining: The most common mining method globally, accounting for a majority share. Equipment used is characterized by larger size, durability, and high-volume handling capacity.

-

Underground Mining: Gaining traction in mature mining markets and where surface mining is not viable. It requires compact, low-emission, and intelligent machinery for narrow spaces and safety compliance.

Unlock key market insights by accessing the sample report through the link .@https://www.maximizemarketresearch.com/request-sample/25027/

Country-Level Analysis

United States

The U.S. mining equipment market is witnessing accelerated growth driven by renewed investments in domestic mining, especially for critical minerals such as lithium and cobalt. Federal incentives aimed at bolstering domestic supply chains and reducing dependency on imports have stimulated mining exploration and production. Mining companies in the U.S. are also early adopters of autonomous and AI-driven equipment, contributing to growing demand for high-tech solutions.

Furthermore, the U.S. houses several key mining equipment manufacturers that dominate the global supply chain. These firms are leveraging advanced digital platforms for equipment tracking, predictive maintenance, and performance analytics.

Germany

Germanys mining equipment sector is known for precision engineering and innovation in automation. Although the country has limited domestic mining activity, its manufacturers are prominent global exporters of underground and mineral processing equipment.

German companies are leading the transition toward greener mining technologies by investing in R&D for electric and hybrid solutions. Additionally, Germanys regulatory environment and industrial emphasis on sustainability make it a benchmark for environmentally responsible mining equipment production.

Competitive Landscape (Commutator Analysis)

The mining equipment market is moderately fragmented with several global and regional players competing on technology, after-sales service, and global reach. Leading companies have adopted aggressive strategies including mergers, product innovations, and regional expansion to gain market share.

Key Players:

-

Caterpillar Inc.: Known for its massive haul trucks and autonomous solutions, Caterpillar remains a global leader with a wide product portfolio and strong after-sales support.

-

Komatsu Ltd.: Offers an extensive range of electric and hybrid mining equipment. The company has made significant advancements in automation and remote operation technologies.

-

Liebherr Group: A strong contender in both surface and underground segments, known for heavy-duty excavators and electric drive technology.

-

Sandvik and Epiroc: Specialize in underground drilling, rock cutting, and material handling solutions with a focus on safety, efficiency, and automation.

-

Hitachi Construction Machinery and Doosan: Gaining market share in the Asia-Pacific region, particularly in mid-range machinery suitable for small to medium-scale operations.

Key strategies across the board include:

-

Investment in R&D for electrification and automation

-

Strategic partnerships with mining firms for co-development

-

Expansion of service networks in emerging economies

-

Integration of digital technologies such as IoT and AI for smart maintenance

Press Release Conclusion

The global mining equipment market is on the cusp of a transformative growth phase. With valuation expected to reach nearly USD 200 billion by 2030, the industry is rapidly evolving under the influence of automation, electrification, sustainability, and rising demand for critical minerals.

As mining operations become more complex and environmentally regulated, the need for intelligent, safe, and efficient equipment is greater than ever. Companies that can deliver sustainable solutions while maintaining high productivity standards will emerge as long-term leaders.

The future of the mining equipment industry will be defined by innovation, collaboration, and the ability to adapt to a rapidly changing resource landscape. Stakeholdersfrom miners and OEMs to investors and regulatorsmust align on digital transformation, sustainability goals, and value-added services to thrive in this dynamic ecosystem.