![]()

Journalist

- ETH ETF’s first-day results outperformed analysts’ estimates of 15-15% of BTC ETFs.

- BlackRock’s ETHA led the way, but Grayscale bled out nearly a half-billion in outflows.

U.S. spot Ethereum [ETH] ETFs had a remarkable debut, clocking over $1 billion in trading volumes. Grayscale’s ETHE, alongside BlackRock and Fidelity ETH ETFs, saw over $100 million in day 1 trading volumes.

The rest, including Vaneck, Franklin and Invesco Galaxy, saw their ETFs hit daily trading volume above $10 million apart from 21Shares.

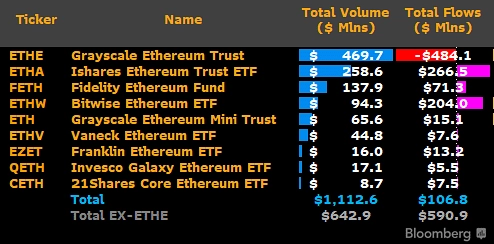

From a flow perspective, Bloomberg data revealed that the products logged $107 million in net inflows, led by $266.5 million from BlackRock’s ETHA and $204 million from Bitwise’s ETHW.

Source: Bloomberg

However, Grayscale’s ETHE was the only one with outflows totaling $484.1 million, while its mini version recorded a $15.1 million inflow.

ETH ETF first day results beats analysts’ estimates

Despite Grayscale’s outflows, the above +$1 billion in trading volume and over $100 million in net flows beat analysts’ estimates.

Bloomberg analyst Eric Balchunas had earlier projected that the products would outperform their ‘20% of BTC ETF’ estimates if BlockRock crossed $200 million in volume.

“Using BlackRock’s ETF as a proxy, $ETHA volume after first hour will be around $50m. If it can pass $200m by EOD, it will be outperforming our ‘20% of BTC’ estimate (given $IBIT did $1b first day).”

Interestingly, ETHA hit $258 million in volume by the end of Tuesday’s trading session. That translates to about 26% of BlackRock’s IBIT first-day volume, beating the estimates.

Commenting on the stellar results, Zaheer Ebtikar of crypto hedge fund Split Capital also reiterated that the day 1 results outperformed analysts’ estimates.

“Final figures on our end showing about $1.3 billion in total volume across ETH ETFs. Roughly 28% of BTC’s debut and substantially higher than most estimates between 15-20%.”

In fact, some products like Vaneck Ethereum ETF (ETHV) eclipsed its BTC ETF based on day 1 performance. Reacting to the explosive results, VanEck’s head of digital asset research, Mathew Sigel, said he was ‘ proud ’ of the fete.

“And proud that $45M of $ETHV traded, beating our day 1 $HODL volumes of $26M!”

However, Grayscale’s ETHE’s outflow fears seem warranted after a $484.1 million outflow on the first day. This was way greater than the GBTC’s $95.1 million outflow during its debut on 11th January.

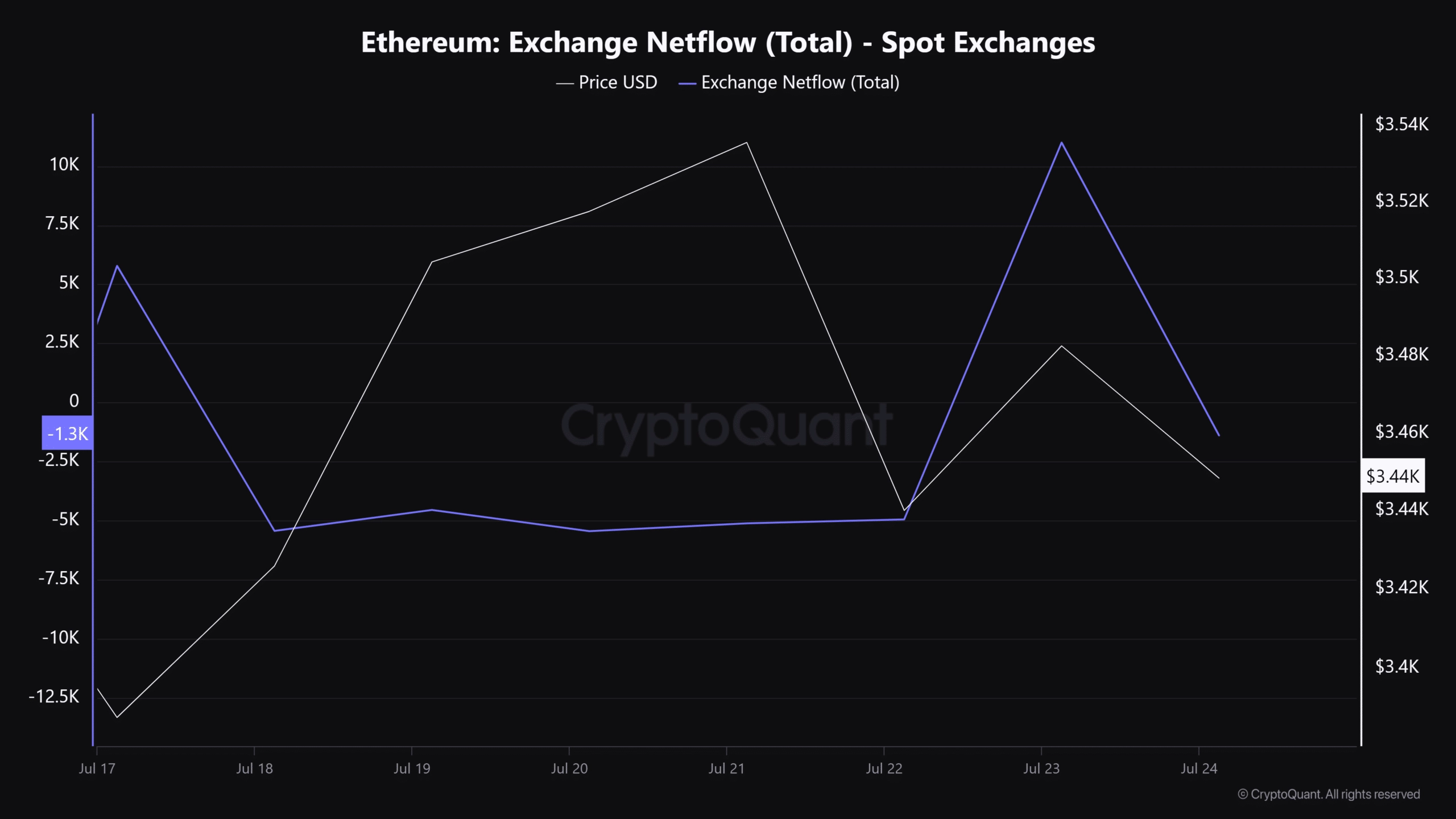

Meanwhile, the ETH price rose negligibly on the ETF debut day. It rose 1.25% and hit $3.54k but declined slightly below $3.5k as of press time.

However, the ETH spot market had no significant sell pressure after the ETF debut, as denoted by a drop in Exchange Netflow.

This meant more ETH was moved from exchanges than in, underscoring increased accumulation of ETH sent to personal wallets.

Source: CryptoQuant