- ETH traders have incurred large losses, with nearly $108M liquidated in 24 hours as the cryptocurrency fell by almost 5%.

- Grayscale’s high-fee Ethereum ETFs in the US are experiencing outflows, while new, more affordable Ethereum ETFs are seeing inflows.

- Market analysis suggests more challenges ahead for Ethereum, impacted by weak fundamentals and broader market pressures.

ETH traders have taken the largest losses in the past 24 hours, with almost US$108M (AU$165M) in long positions liquidated. This comes as the second-largest crypto has dropped close to 5% over the same timeframe.

Related: TON Blockchain Introduces Gasless Transactions with New Smart Wallet Standard

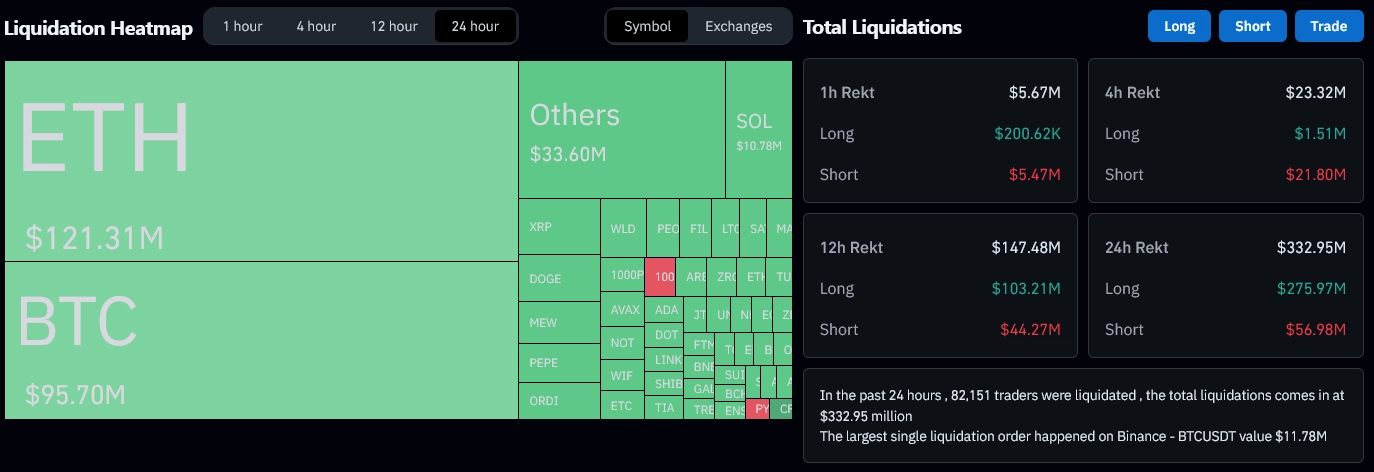

Data from Coinglass shows that more than 80,000 traders have been liquidated with total losses close to US$333M (AU$508.8M). While ETH traders suffered the largest total losses, the largest single loss was a whopping US$11.78M (AU$17.99M) loss of BTCUSDT on exchange Binance.

24-hour liquidation heatmap and total liquidations, source: Coinglass

24-hour liquidation heatmap and total liquidations, source: Coinglass

ETH Funds Experience Similar Scenario as BTC Funds

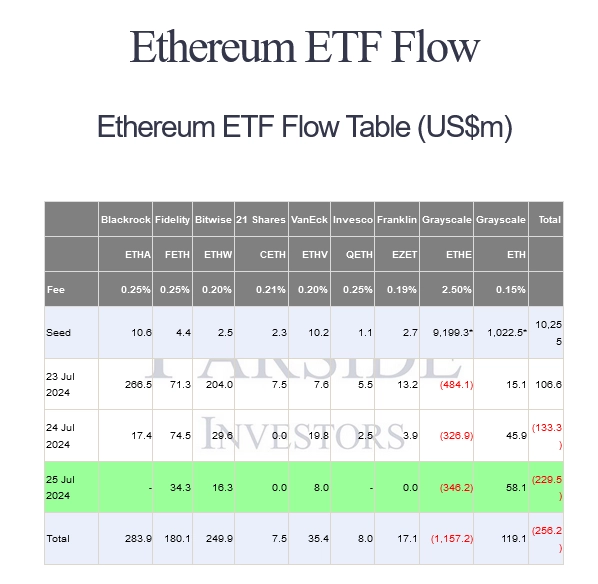

As we enter the third day of trading of the new Spot ETH exchange-traded funds (ETFs) in the United States, flows out of Grayscale’s fund continue.

Advertisement

According to data from Farside Investors, the largest of the new funds, Blackrock’s ETHA, currently holds US$283.9M (AU$433.77M) in ETH, while the second-largest fund, Bitwise’s ETHW, now holds US$249.9M (AU$381.72M).

Ethereum ETF flows, source: Farside Investors

Ethereum ETF flows, source: Farside Investors

Since launching its ETFs, Grayscale’s ETHE has experienced outflows totalling US$1,157M (AU1,767M) – despite being the largest global Ethereum fund, holding about 2.2% of the world’s total Ether supply and charging a 2.5% fee

Meanwhile, Grayscale’s newer, more affordable Ethereum Mini Trust, ETH, trades at about US$3 (AU$4.58) per share with a low 0.15% expense ratio, waived until the fund reaches US$2B (AU$3B) in AUM, appealing to retail investors.

Related: Hashdex Files for Spot Crypto Index ETF, the First Multi Asset Fund in United States

Like with the Bitcoin funds, the money is flowing from the high-fee Grayscale fund to the newer funds. Similarly to the Bitcoin funds, the launch appears to have been a ‘buy the rumour, sell the news’ type event. The ETH price dropped from close to US$3,500 (AU$5,342) around the launch, to now US$3,184 (AU$4,860) at the time of writing.

Ethereum (ETH), 7-day graph, source: CoinMarketCap

Ethereum (ETH), 7-day graph, source: CoinMarketCap

Analysts Say Market is Entering Weak Period

A report by 10x Research reveals that the selling may not be over and more trouble could be coming for ETH traders.

They wrote that, beyond the ETF hype, other external factors have further pressured the crypto market. This includes the coinciding Bitcoin distributions from Mt. Gox and a weak start to the US tech earnings season, particularly with poor performances from major players like Alphabet and Tesla.

They added:

If this trend continues, crypto will need more help to rally. Ethereum might be the weakest link, where fundamentals (new users, revenues, etc.) have been stagnant or lower.

10x Research

10x Research

Related: Atari Launches Classic Arcade Games on Ethereum Layer-2, You Can Even Win Weekly Prizes

Ignas (@DefiIgnas) agrees with this short to medium term bearish view. Despite holding a sizable bag of ETH Ignas said “the sentiment on ETH isn’t great”. He points to failed scaling of Ethereum’s layer-1, less than expected added value to layer-2s and low rewards from airdrops for ETH’s struggle.

So, unless positive changes occur, Ethereum may have difficulties to regain momentum in the near term.