Market Estimation & Definition

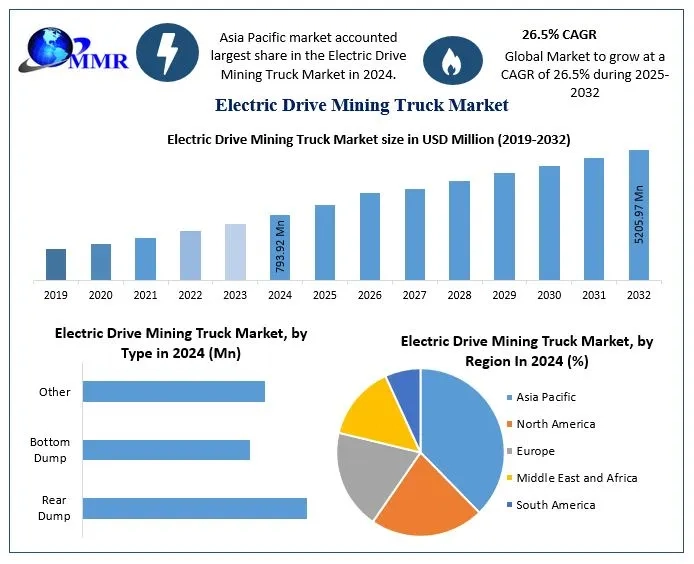

The global Electric Drive Mining Truck Market is experiencing a period of dynamic transformation, driven by rising environmental regulations, advancements in electric powertrains, and demand for more efficient mining operations. As of 2023, market valuation is estimated at approximately USD 793.92 Million, with forecasts projecting the market to reach USD 5205.97 Million by 20252032, growing at a CAGR of 26.5% during the forecast period.

Electric-drive mining trucks refer to heavy-duty vehicles used primarily in mining and quarrying operations that are powered wholly or partially by electric propulsion systems. These systems can include battery-electric (BEV), hybrid electric (HEV), hydrogen fuel cells, or trolley-assist mechanisms. Designed for transporting heavy payloads over long distances, these trucks offer improved torque, reduced greenhouse gas emissions, and lower maintenance costs compared to conventional diesel trucks.

Request Free Sample Report https://www.maximizemarketresearch.com/request-sample/183384/

Market Growth Drivers & Opportunities

Environmental Regulations & Sustainability Goals

Governments and mining companies worldwide are aligning with global sustainability goals. Stricter emissions norms, carbon pricing, and green mining initiatives have made diesel-operated mining trucks less viable in the long term. Electric-drive trucks, which offer zero or significantly reduced emissions, are emerging as a key solution to decarbonize mining fleets.

Lower Total Cost of Ownership (TCO)

Although electric mining trucks have a higher initial cost, their total cost of ownership over the lifecycle is significantly lower due to savings on fuel and maintenance. Reduced mechanical complexity, fewer moving parts, and declining battery costs contribute to economic feasibility over the long term.

Technological Advancements

Innovations in lithium-ion battery chemistries, solid-state batteries, regenerative braking, and energy-dense storage have enhanced the range, performance, and safety of electric mining trucks. Integration with autonomous driving technologies and advanced telemetry has further accelerated their adoption.

Infrastructure Expansion & Government Support

Many governments and industrial zones are investing in charging infrastructure, subsidies, and tax incentives for electric heavy-duty vehicles. This is particularly impactful in regions with mining-heavy economies, where large-scale adoption of electric trucks can significantly reduce national carbon footprints.

Rising Demand in Emerging Economies

Countries like India, Brazil, and China are experiencing exponential growth in the mining sector, particularly for materials like coal, copper, and lithium. The rising demand for sustainable mining operations in these regions presents a major growth opportunity for electric-drive mining truck manufacturers.

Market Segmentation Analysis (Descriptive Format)

The electric-drive mining truck market is segmented by type, application, payload capacity, drive system, and powertrain technology.

By Type:

-

Rear Dump Trucks dominate the segment due to their wide usage in surface mining operations, where high payloads need to be transported over long distances. These trucks are robust, versatile, and preferred for open-pit operations.

-

Bottom Dump Trucks are used primarily in underground and confined mining environments, where precise material unloading is critical. They are gaining popularity in tunnel and coal mining operations.

-

Other specialized trucks, including side-dump and articulating haulers, serve niche requirements in construction and quarrying operations.

By Application:

-

Surface Mining holds the largest market share, primarily due to the volume of materials moved and the suitability of electric-drive trucks in wide, open environments.

-

Underground Mining is the fastest-growing segment, driven by strict air quality regulations and the need to reduce ventilation costs. Electric trucks eliminate diesel exhaust, improving worker safety and environmental compliance.

-

Quarrying & Construction applications are emerging as new growth areas for mid-sized electric trucks with lower payload capacities and shorter operating ranges.

By Payload Capacity:

-

Trucks with payloads of less than 100 tons are used in light-duty or auxiliary roles.

-

The 100200-ton category is rapidly gaining traction due to growing adoption by medium-scale mining operations.

-

Trucks with 200300 tons are widely used in standard open-pit mining environments.

-

Above 300 tons trucks are employed in mega-scale operations, and although currently limited, their market share is expected to increase as battery and drivetrain technologies evolve.

By Drive System:

-

AC Drive Systems lead the market due to superior torque control, efficiency, and better adaptability to electric powertrains.

-

DC Drive Systems are still in use but are expected to decline due to higher maintenance and lower performance characteristics.

By Powertrain Technology:

-

Battery Electric Vehicles (BEVs) dominate the segment, offering zero tailpipe emissions and compatibility with existing charging infrastructure.

-

Hybrid Electric Vehicles (HEVs) are being deployed as a transitional solution, especially in mines lacking full charging infrastructure.

-

Hydrogen Fuel Cell Trucks are an emerging technology, offering longer ranges and shorter refueling times, ideal for remote or high-altitude mining sites.

To know about the Research Methodology :- https://www.maximizemarketresearch.com/request-sample/183384/

Country-Level Analysis: USA & Germany

United States

The U.S. electric-drive mining truck market is experiencing robust growth driven by infrastructure investments, technological advancements, and sustainability goals. Federal and state-level programs supporting the electrification of heavy-duty fleets have encouraged mining operators to explore electric alternatives. Mining operations in states like Arizona, Nevada, and Wyoming have begun transitioning to electric fleets. Major manufacturers are based in the U.S., providing both technological and logistical advantages. Moreover, autonomous electric mining trucks are undergoing extensive pilot testing in controlled mining zones.

Germany

Germany is emerging as a leader in electric-drive mining technology within Europe. With strong engineering capabilities and a focus on renewable energy integration, the country is rapidly adopting electrified machinery across various industrial sectors, including mining. Government incentives and EU-level decarbonization targets have created a supportive environment for electric truck deployment. German OEMs are collaborating with mining companies to test large-scale electric haulers in limestone and coal mining operations. Germany also serves as a hub for research into advanced battery systems and fast-charging infrastructure for heavy-duty vehicles.

Competitor Analysis

The competitive landscape of the electric-drive mining truck market is characterized by innovation, partnerships, and a focus on sustainability. Key players are investing heavily in R&D, expanding product portfolios, and forming strategic alliances to gain market share.

-

Caterpillar Inc. is at the forefront of the transition, offering hybrid and electric mining trucks integrated with autonomous technology.

-

Komatsu Ltd. has developed electric and trolley-assist systems with modular designs suitable for a wide range of mining environments.

-

Volvo Group is expanding its electric powertrain capabilities to include mining and construction vehicles.

-

Hitachi Construction Machinery focuses on Asia-Pacific markets and has developed multiple electric truck variants.

-

BelAZ, based in Eastern Europe, has introduced some of the worlds largest electric-drive mining trucks, designed for ultra-heavy-duty applications.

-

Liebherr, Epiroc, and Sandvik are also playing crucial roles, particularly in Europe and South America.

Emerging players from Asia are entering the market by offering competitively priced, mid-range electric trucks suited for smaller mining operations. These companies are expected to disrupt traditional OEM dominance, especially in price-sensitive markets.

The competition is also marked by joint ventures between mining companies and technology firms to develop tailor-made solutions. Charging infrastructure providers and battery developers are becoming increasingly vital partners in this ecosystem.

Press Release Conclusion

The global electric-drive mining truck market is poised for transformative growth, supported by favorable regulatory environments, technological breakthroughs, and a collective push toward sustainable mining practices. As mining companies seek to reduce their carbon footprint and operating costs, electric-drive trucks offer a future-ready solution that addresses both economic and environmental imperatives.

The transition to electric mining trucks is no longer speculativeit is underway. While battery-electric vehicles currently lead the transition, hydrogen fuel cells and hybrid models are gaining traction in specific applications. With the rise of autonomous systems and the expansion of charging infrastructure, the next decade will witness significant fleet conversions across the globe.

In developed nations like the United States and Germany, public and private investments are accelerating the adoption curve. Meanwhile, emerging economies are expected to leapfrog directly into electric technologies to meet rising demand sustainably.

Looking ahead, the electric-drive mining truck market will be defined by:

-

Scalable, modular designs adaptable to varying terrain and payloads

-

Smart integration of autonomy and predictive maintenance systems

-

Strategic collaborations between OEMs, tech providers, and mining firms

-

Rapid expansion in Asia-Pacific and Latin America

Industry stakeholders must now position themselves to leverage this momentum and play a central role in reshaping the future of global mining.