- Recent headlines about Chinese mine suspensions have caused a significant rally in lithium stock prices, with major producers seeing notable gains.

- Despite the stock surge, analysts are warning that the global lithium market remains well-supplied, and the actual impact of supply disruptions might be less significant than current market sentiment suggests.

- Factors such as rising inventories, new supply projects, and advancements in battery technology like LFP and sodium-ion batteries continue to put downward pressure on long-term lithium prices.

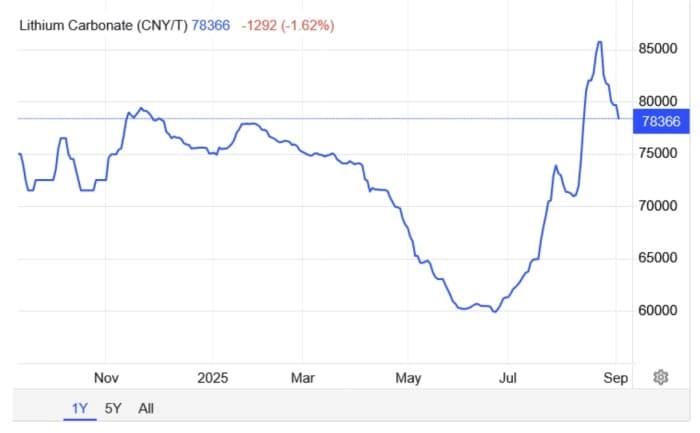

Shares of lithium miners have been on a tear over the past couple of weeks, reversing months of losses on potential supply disruptions. Last month, Chinas giant EV battery maker, Contemporary Amperex Technology, or CATL, announced that it had suspended production at one of its main mines following the expiration of its operating license after failing to extend a key mining permit. CATL said that it had stopped operations at the Jianxiawo mine--one of the world's largest lithium mines, producing ~3% of world supply--prompting speculation that Beijing might suspend other projects in a bid to address overcapacity across the economy. Sigma Lithium (NASDAQ:SGML) led the rally amongst lithium producers, jumping +17.3% as soon as the development hit news feeds; Lithium Americas (NYSE:LAC) +10.2%, Piedmont Lithium (NASDAQ:PLL) +8.7%, Albermale (NYSE:ALB)+7.8% and SQM (NYSE:SQM) +7.6%. The news also boosted lithium hydroxide futures to the highest level in more than a year, while the industrys favorite benchmark, the Global X Lithium & Battery Tech ETF (NYSEARCA:LIT), jumped nearly 6% toward a nine-month high.

Source: Trading Economics

Charlotte, North Carolina-based lithium producer, Albemarle, has received several Wall Street upgrades following the development. UBS has upgraded ALB to Neutral from Sell with an $89 price target, good for 4.8% upside from current price. UBS has forecast spodumene prices could climb as much as 32% with lithium chemical prices climbing up to 17% over the next three years thanks to mining suspensions in China. The bank has highlighted several critical potential supply disruptions, including CATL's Jianxiawo mine suspension in August, Zangge Mining's halt on July 14 and seven lepidolite mines in Yichun that could be up for closure after September 30. UBS has also pointed to production limits at Citic Guoan's Qinghai brine facility in late August. UBS has predicted that Jianxiawo could potentially idle for a full year amid strict enforcement of mining rights inspections by Beijing. Lithium stocks have continued tacking on gains, with ALB up 16.7% over the past 30 days.

However, a cross-section of Wall Street is warning that lithium bulls are getting ahead of themselves. The global lithium market remains well-supplied, and actual supply disruptions may be less significant than the recent surge in stock prices suggests. To wit, Chinas lithium carbonate inventories surged more than 30% to 150 thousand tonnes in May, with producers continuing to jostle for market share despite low prevailing prices.

The actual supply disruption could be more muted than equities might suggest , UBS said in a research note.

KeyBanc analyst Aleksey Yefremov has warned investors from jumping on the lithium bandwagon, saying lithium prices in the longer term are "lacking fundamental support" thanks to rising inventories. Despite the recent rally, lithium prices have entered a prolonged trough, reflecting not just the mechanics of oversupply and slower EV uptake, but also the strategic maneuvering of governments and producers across three continents. Chinas subsidy recalibrations, U.S. tariff barriers, and Chiles push for greater state control have reshaped cost curves and capital flows, while new African and Australian supply is testing price discipline. Meanwhile, theres uncertainty regarding whether Beijing will stick to aggressive capacity cuts. Analysts warn that if the supply cuts do not materialize to the extent expected, market sentiment could reverse, leading to a correction in lithium equities.

Lithium supply has continued to outpace demand, defying earlier predictions for inventory normalization in 2025. Lithium prices continue to be depressed due to a combination of increased global supply from newly developed projects and production cuts, alongside technological advancements that reduce lithium demand per battery, such as the adoption of LFP batteries and the rise of sodium-ion batteries . LFP batteries are a type of rechargeable battery that use lithium iron phosphate (LiFePO?) as their cathode material. They are known for their safety, long lifespan, and lower cost compared to some other lithium-ion chemistries due to the absence of expensive and conflict-prone materials like cobalt and nickel. This makes them a good choice for applications prioritizing longevity and stability, such as electric vehicles (EVs) and renewable energy storage systems. Meanwhile, sodium-ion (Na-ion) batteries are a promising, emerging alternative to lithium-ion batteries due to their potential lower costs, improved safety, and ability to operate at lower temperatures. While still in early development with challenges like lower energy density and incomplete supply chains, Na-ion batteries offer faster charging and longer lifespans than some lithium-ion counterparts, making them a significant technology for future energy solutions, particularly in areas with established sodium resources like India.

By Alex Kimani for Oilprice.com

More Top Reads From Oilprice.com