Bitcoins rising price and falling whale wallet count mirror the 2021 top, but relentless ETF inflows and public company buys complicate the bearish narrative. This suggests momentum may outlast fractal models, warning of a near-term peak.

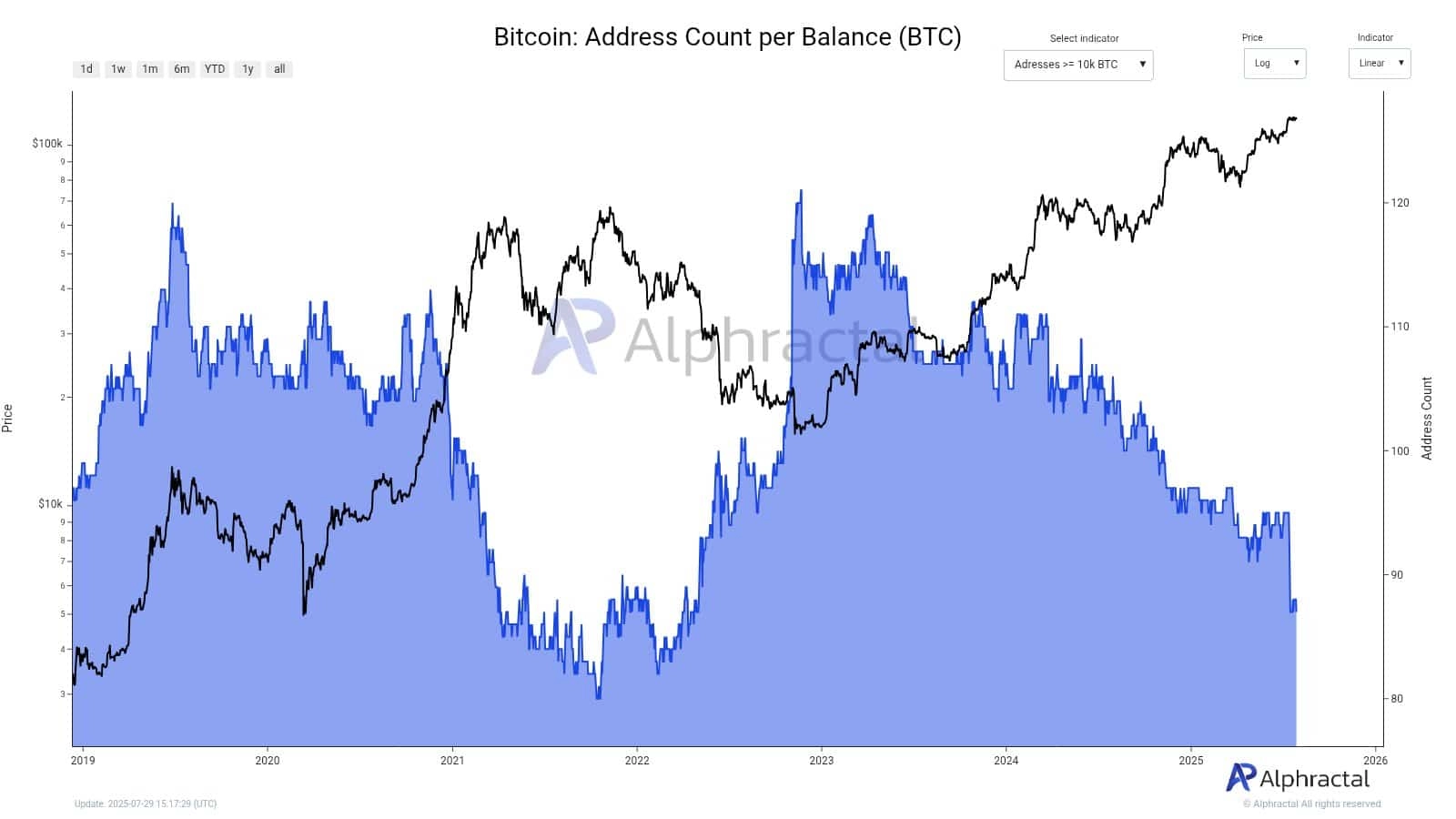

According to on-chain data from Alphractal, Bitcoin [BTC] appears to be mirroring a pattern similar to the one that preceded the end of the 20202021 bull market.

The pattern is: the price is climbing even as the number of large-holding addresses is dropping.

This divergence is raising concerns among some analysts that the current bull cycle may be on its last legs.

Alphractal analyst Joao Wedson believes the Bitcoin bull market may have only a few weeks left, pointing to a steady decline in wallets holding more than 10,000 BTC.

He expects the cycle to end by October, aligning with broader fractal-based projections.

As of press time, addresses in this cohort had dropped below 90.

Yet Bitcoins price action has stayed resilient, holding above $117,265 since the 17th of July local top, according to TradingView.

Source: Alphractal

Public companies keep buying

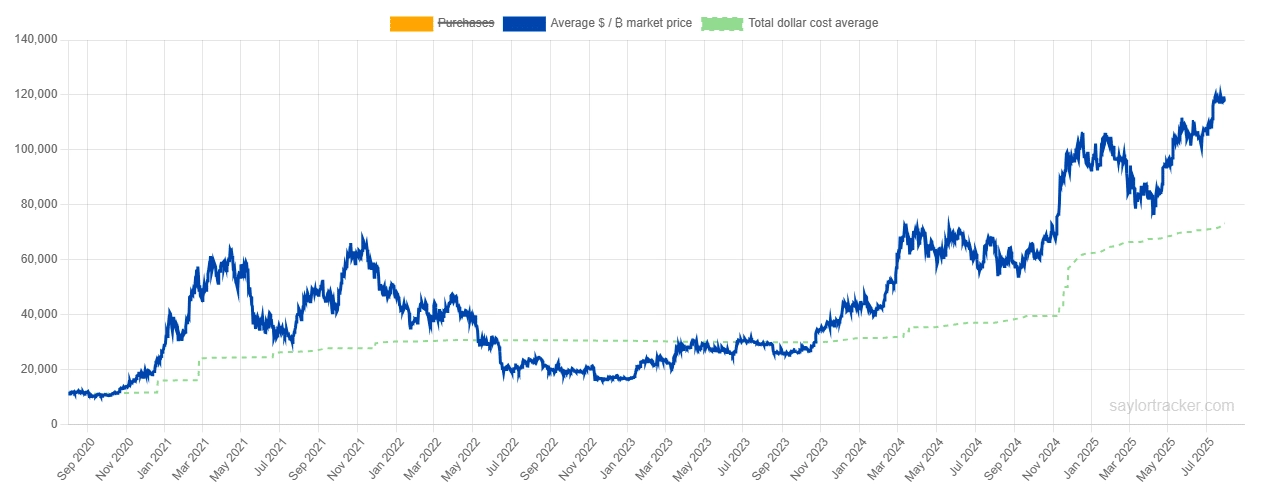

Despite bearish projections, liquidity inflow from public companies trading Bitcoin has not slowed. MicroStrategy, led by Michael Saylor, increased its Bitcoin holdings using funds raised through convertible notes.

The company added $2.46 billion worth of Bitcoin, boosting its portfolio to $74.18 billiona 60% surge, according to SaylorTracker.

Source: SaylorTracker

The trend isnt limited to MicroStrategy. Another publicly traded firm, Mara Holding, purchased $950 million worth of Bitcoin in the past day.

Bitcoin Dominance among publicly traded companies continues to rise. The 42 firms in this category now hold 4.28% of Bitcoins total supply, with MicroStrategy alone controlling 2.894%.

This growing interest from public companies suggests that, despite analyst predictions of a potential Bitcoin decline in August or September, on-chain sentiment and market behavior may point in the opposite direction.

ETFs remain bullish

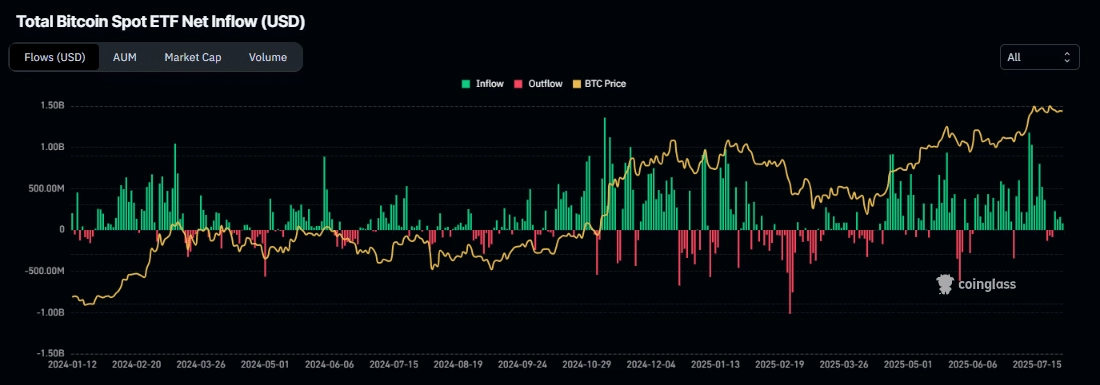

Naturally, traditional finance players are also keeping the taps open. Bitcoin spot ETFs have maintained bullish momentum, with CoinGlass showing that total assets under management sat at $151.28 billion.

Source: CoinGlass

During July alone, $541.6 million worth of Bitcoin was sold, compared to $4.83 billion bought in the same period, according to CoinGlass.

If this buying pattern continues into Q3, it could mute any downside projected by fractal indicators. It may also suggest that a market cooldown, if it arrives, could be a shallow pullback rather than a full-blown reversal.