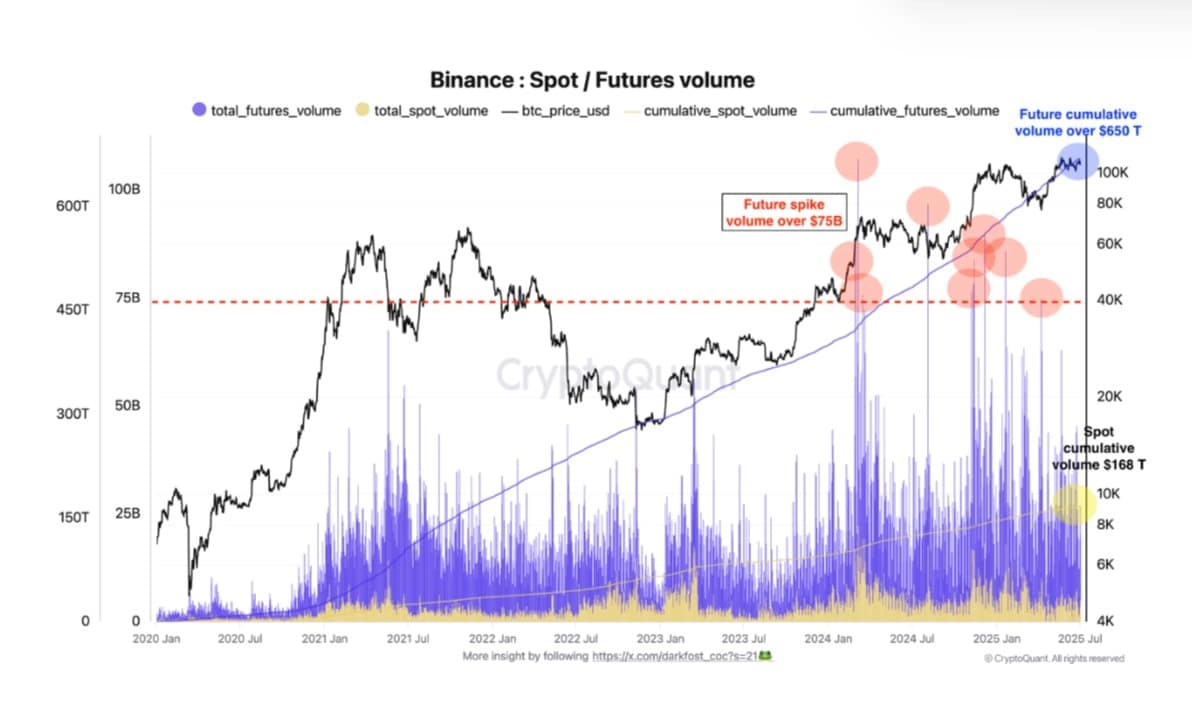

- Bitcoin Futures volume on Binance has exceeded $650 trillion, surpassing spot volume by $482 trillion.

- Can Bitcoin sustain growth if 75% of its volume is purely speculative?

With Bitcoin [BTC] holding firmly above $100K, analysts are debating whats behind the cryptocurrencys resilience.

Analyst Darkfost from CryptoQuant noted a structural shiftBinance had processed over $650 trillion in BTC Futures Volume since 2019.

In comparison, Spot Volume only reached $168 trillion in the same period, making it four times smaller.

When derivatives roar, does the spot market even matter anymore?

Source: CryptoQuant

This widening gap between Spot and Futures markets marks a true power shift that has reshaped the Bitcoin market. Derivatives, not investor conviction, are driving the current market cycle.

In this cycle alone, derivatives dominance surged significantly, with Daily Futures Volumes exceeding $75 billion multiple times.

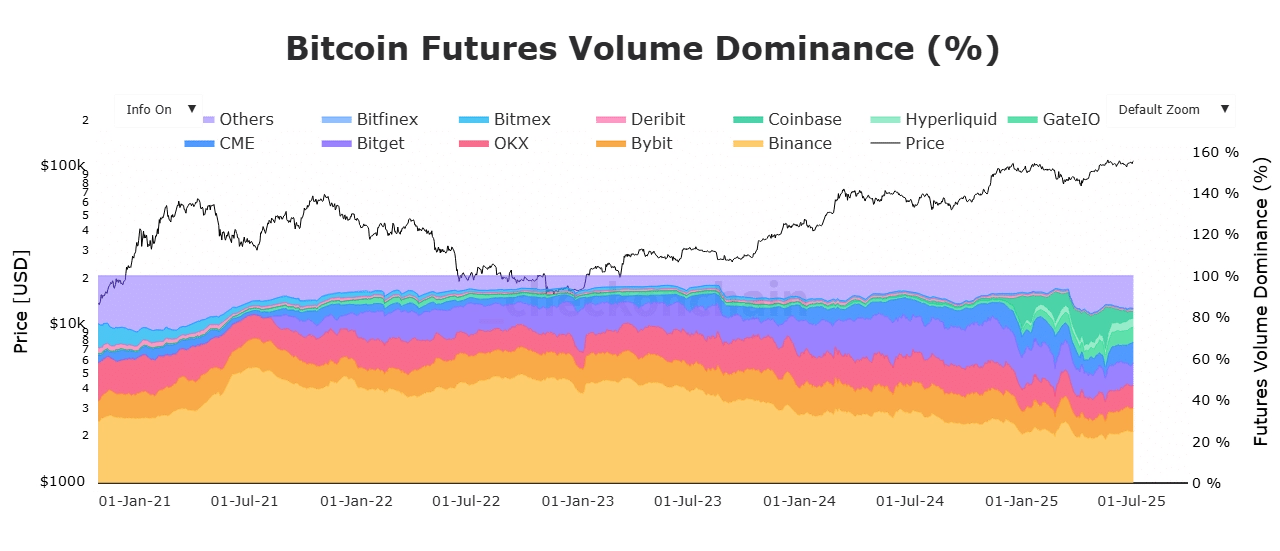

Amid this, Binance continued to dominate, with its Futures Volume Dominance hiking to 24.8%, outpacing other exchanges, according to Checkonchain.

Source: Checkonchain

Futures drive 75% of BTCs movement

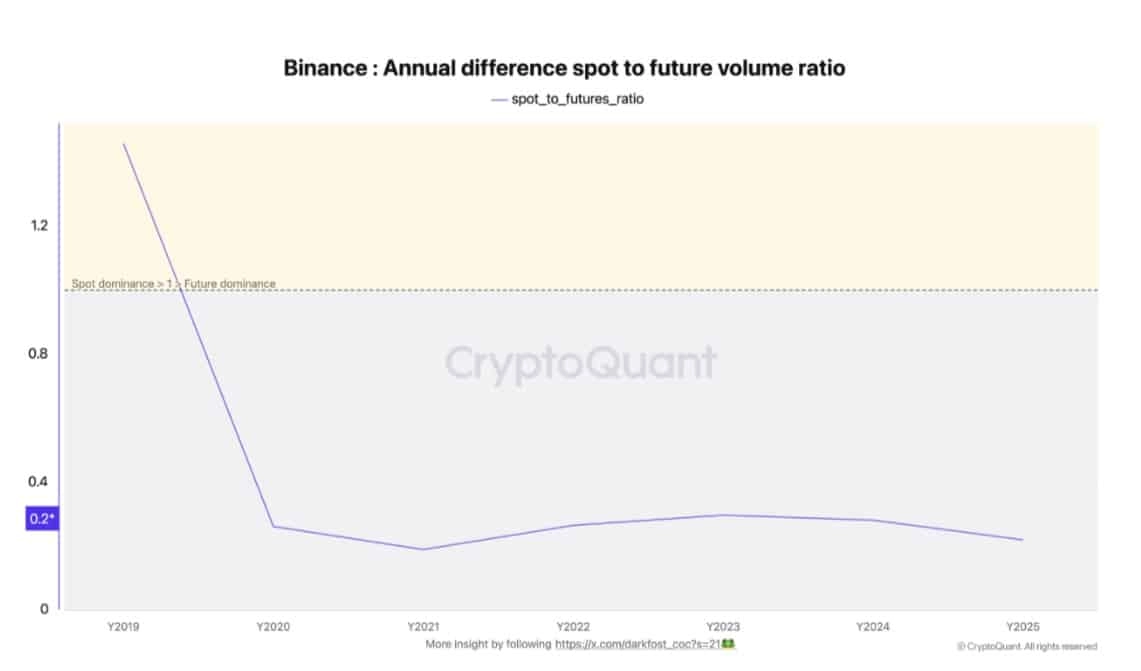

Interestingly, as the dominance of derivatives soared, Bitcoin faced more speculation than at any other time in its history.

Source: CryptoQuant

At press time, the Spot-to-Futures Volume Ratio stood between 0.21 and 0.26, depending on the methodology.

This means 75% of Bitcoins market activity is now derivatives-led, a massive divergence from past cycles, where Spot activity held more sway.

The speculation isnt just in the ratio.

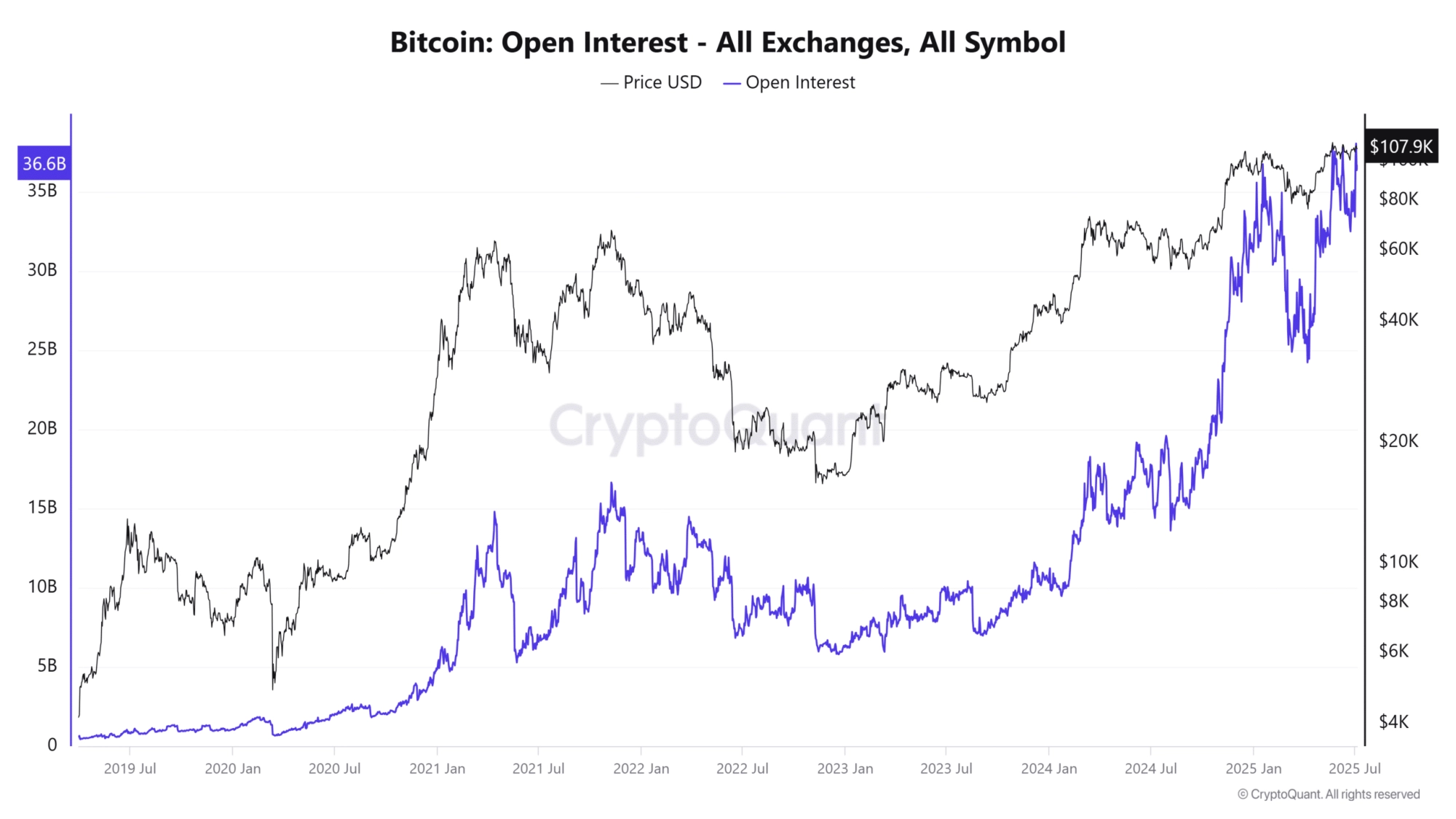

Amid this, Bitcoins Open Interest (OI) continued to rise, to $36.6 billion at press time a slight drop from the ATH of $38 billion recorded during the past week.

The rising OI implies that most capital flowing into the market is being directly allocated to the futures market.

Source: CryptoQuant

When OI rises while the Spot-to-Futures ratio drops, its a classic setup: traders are driving price momentum while organic demand lags.

Pump or fakeout?

Bitcoins growing dominance in the derivatives market, while the spot market lags, presents both risk and opportunity.

On one hand, this imbalance increases the chance of a fakeout rally, where traders inject capital to trigger liquidations and manipulate price movements.

On the other hand, Bitcoin still has room to grow, even without strong organic demand. As speculative traders flood in, they can continue driving prices higher.

In simple terms, if derivatives activity keeps rising, Bitcoins price could see more sustained upward momentum on the charts.

However, volatility is now higher than before. Even a small shift in market sentiment could lead to sharp losses, with Bitcoin potentially dropping to $105,104.