After achieving its highest weekly close to date, Bitcoin (BTC) is now attempting to confirm two crucial levels as support before continuing its rally to new highs. Some analysts have suggested that the cryptocurrency may be experiencing a calm before the storm phase.

Bitcoin managed to close above two crucial levels over the past few days, recording its highest weekly close in history. Last week, the flagship crypto positioned itself for a reclaim of its final major weekly resistance around $109,000 after nearing this area for four days.

On Sunday, BTC surged above the key barrier and closed the week around the $109,200 mark, also successfully confirming its diagonal daily trendline as support. Now, the cryptocurrency is retesting the final resistance to confirm the breakout.

Rekt Capital affirmed that the goal is to turn this resistance into support, as it could push BTC to new all-time highs (ATH). He explained that given how price barely Weekly Closed above the final Weekly resistance, it offers very little chance for price to cleanly retest this level into support; that is, this retest is likely going to be a volatile one.

Nonetheless, the analyst noted that the cryptocurrency has significant High Timeframe (HTF) support beneath it that should act as a demand area to springboard price into Price Discovery Uptrend 2 over time.

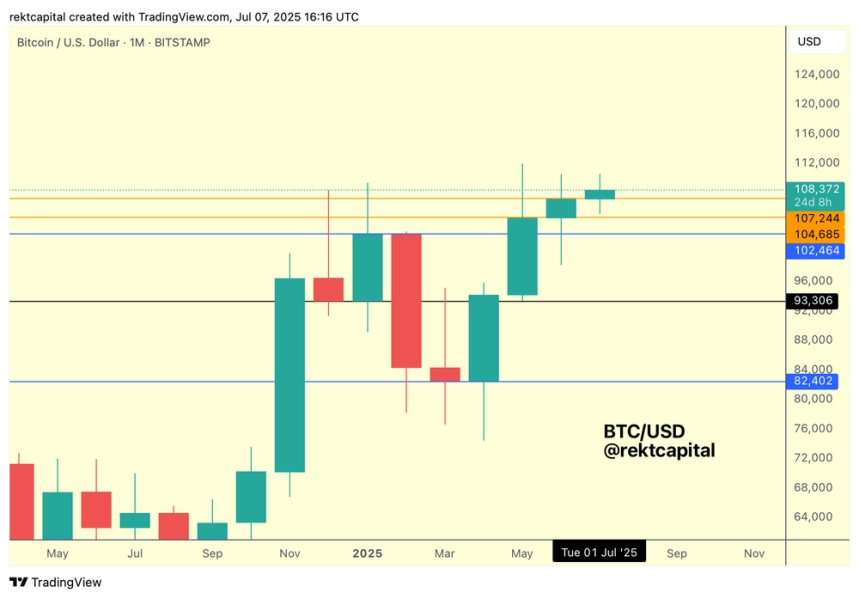

BTCs Crucial HTF support levels. Source: Rekt Capital

BTCs Crucial HTF support levels. Source: Rekt Capital

Notably, Bitcoin reclaimed and held the high zone of its re-accumulation range, around the $104,400 mark, as support over the past two weeks. Meanwhile, June Monthly Closed above the $102,464 level and retested it post-breakout to enable this current July upside candle, setting it as a monthly support.

Additionally, the $107,244 level also emerged as a crucial area after last months close, driving BTC back to its retesting phase.

Rekt Capital considers BTCs current phase as the calm before the storm, adding that for as long as the post-breakout retest will continue, Bitcoin will continue to be positioned for its second Price Discovery Uptrend. However, he pointed out that it is currently locked between $104,400 and $111,000 levels so far this month.

Daan Crypto Trader warned investors that the upcoming days could be crucial for BTCs price action this month. He highlighted that Bitcoin has tended to set its monthly high or low within the first 12 days over 80% of the time, before price trends around 20% in the opposite direction.

BTCs start-of-month performance over the past few months. Source: Daan Crypto Trades on X

BTCs start-of-month performance over the past few months. Source: Daan Crypto Trades on X

Remarkably, June was an exception after Bitcoin remained relatively stable with only small moves in each direction. Now, the analyst thinks its time to be on the lookout again for any big move up or down within the first 12 days to potentially determine BTCs trend for the rest of the month.

For now, there has been little action in July yet, Daan stated, but added that technically, were still looking perfectly around the current levels. He asserted that, with the slower pace during the summer, BTC could remain within its current range until a real move up begins at the end of Q3 and start of Q4.

The trader concluded that the cryptocurrency must officially break out of its range before investors get excited for much higher later this year.

As of this writing, Bitcoin is trading at $107,973, a 1% decline in the daily timeframe.

Bitcoins performance in the one-week chart. Source: BTCUSDT on TradingView

Bitcoins performance in the one-week chart. Source: BTCUSDT on TradingView

Featured Image from Unsplash.com, Chart from TradingView.com