Reason to trust

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reporting and publishing

How Our News is Made

Strict editorial policy that focuses on accuracy, relevance, and impartiality

Ad discliamer

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin (BTC) has seen a slight retreat after reaching an intraday high of $106,704. At the time of writing, the asset trades at $104,686, reflecting a mere 0.4% increase in the last 24 hours. Despite this slight pullback, BTC remains within 3.8% of its all-time high of $109,000 set in January, indicating that bullish momentum is still largely intact.

Amid this price performance, data suggests that BTC’s price behavior remains supported by strategic accumulation patterns rather than short-term speculation. The return of large-scale withdrawals from centralized exchanges like Binance and Kraken may be contributing to this reduced sell-side pressure.

Exchange Outflows and MVRV Ratio Support Accumulation Thesis

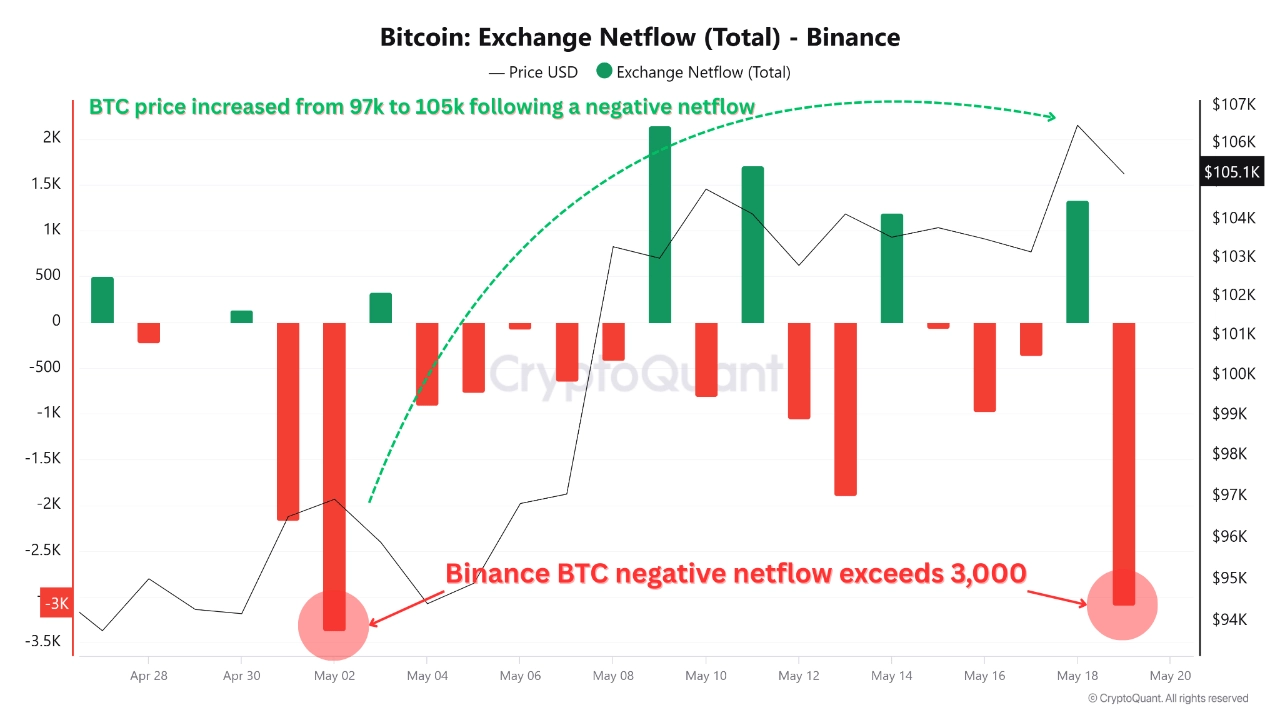

Amr Taha, a contributor to CryptoQuant’s QuickTake platform, highlighted a noteworthy shift in investor behavior. According to Taha’s latest analysis, over 3,090 BTC, valued at approximately $325 million, were withdrawn from Binance in a single day. This followed an earlier 76,000 ETH withdrawal from Binance and a separate 170,000 ETH exit from Kraken.

Binance exchange netflow. | Source: CryptoQuant

Binance exchange netflow. | Source: CryptoQuant

These movements suggest investors are increasingly transferring assets off exchanges, a behavior typically linked to long-term holding strategies. Taha notes that this trend aligns with broader developments in the industry, such as Circle’s reported IPO plans and acquisition discussions involving Coinbase and Ripple.

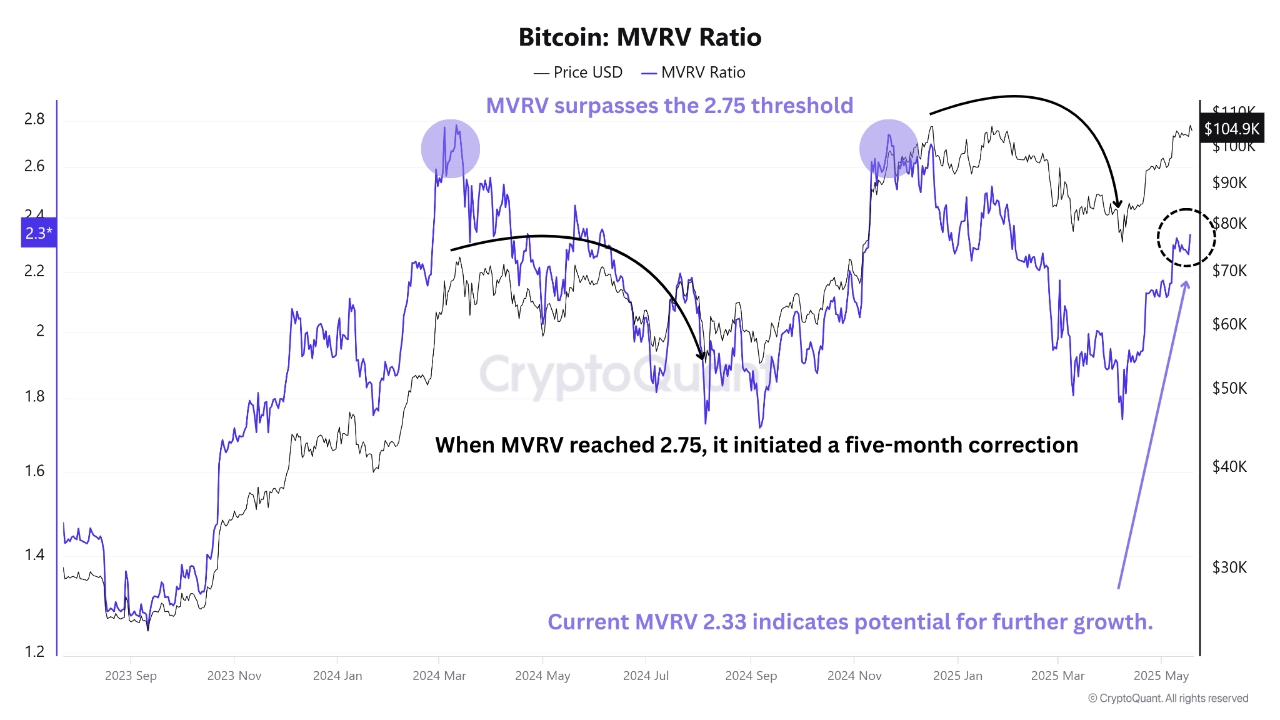

Taha’s analysis also emphasizes the importance of the MVRV (Market Value to Realized Value) ratio in gauging market sentiment. Currently standing at 2.33, the MVRV remains below the 2.75 threshold that has historically triggered major corrections.

Bitcoin MVRV ratio. | Source: CryptoQuant

Bitcoin MVRV ratio. | Source: CryptoQuant

The last instance of MVRV crossing that level coincided with a prolonged five-month downturn. In contrast, the current level suggests that Bitcoin is not yet in overheated territory, which could give the market room to move higher before heavy profit-taking begins.

Bitcoin Market Structure Points to Reduced Sell Pressure

Taha concludes that the market remains in an accumulation phase, driven by reduced exchange reserves and a neutral MVRV reading. The decline in exchange-held BTC supply lowers the risk of large-scale sell-offs, especially if buyer demand holds steady. This dynamic could help sustain the current uptrend, barring unexpected external shocks.

Moreover, the combination of falling exchange balances and a sub-critical MVRV ratio paints a picture of a market not yet near euphoric excess. Instead, the conditions suggest a cautious optimism among investors, with many choosing to store rather than liquidate their holdings, according to Taha.

The analyst added that the gradual offloading of exchange balances supports the view that institutional and large retail participants are still positioning for future upside. Should the MVRV ratio climb toward the historical trigger point of 2.75, that sentiment may begin to shift, but for now, on-chain indicators suggest that Bitcoin’s rally may still have room to grow.

Featured image created with DALL-E, Chart from TradingView

Meet Samuel Edyme, Nickname - HIM-buktu. A web3 content writer, journalist, and aspiring trader, Edyme is as versatile as they come. With a knack for words and a nose for trends, he has penned pieces for numerous industry player, including AMBCrypto, Blockchain.News, and Blockchain Reporter, among others.

Disclaimer: The information found on NewsBTC is for educational purposes only. It does not represent the opinions of NewsBTC on whether to buy, sell or hold any investments and naturally investing carries risks. You are advised to conduct your own research before making any investment decisions. Use information provided on this website entirely at your own risk.