The best zero fee crypto exchanges to buy Bitcoin and cryptos are Best Wallet, Binance, MEXC, Bybit, Coinbase, Kraken, KuCoin, Bitfinex, and Bitstamp. Since all zero-trading-fee crypto exchanges offer different products and services in addition to low fees, choosing which one best suits your needs can be challenging.

Therefore, we reviewed various free crypto trading platforms using factors like security, supported cryptocurrencies, ease of use, and liquidity to determine the best ones. In addition to the compiled list, this article also dives deep into the types of fees that apply on crypto exchanges, including trading fees (maker & taker fees), deposit fees, withdrawal fees, and margin/futures fees.

In addition, we will answer essential questions, like how can I minimize exchange fees? What are the criteria to evaluate when choosing the best no-fee exchange? And how to buy Bitcoin & crypto without fees?

But before we proceed, the table below provides a detailed comparison of the best zero fee crypto exchanges for buying Bitcoin and cryptos in 2025.

Our Rating Zero Fee Feature Supported Crypto Additional Features Best Wallet 9.8 Zero trading fees for all spot trades and crypto deposits60+

Non-custodial wallet, multi-chain support, $BEST token presale, DeFi integration Binance 9.7 Cheapest crypto exchange for fiat to crypto transactions 500+ Binance Launchpad, Binance Earn, and Binance Web3 Wallet. MEXC 9.5 Zero fees for special trading pairs 2700+ MEXC Launchpool and Kickstarter, and MEXC referral program Bybit 9.5 Zero fee trading for market makers and takers 650+ Copy trading tools, Bybit card, and trading bots. Coinbase 9.1 No fees for Coinbase One subscribers 250+ Coinbase card, Coinbase Pro, and Coinbase Wallet. Kraken 8.8 Zero fee trading for high volume traders. 200+ Crypto staking, Kraken Pro, and educational resources. KuCoin 8.6 Best for negative fee rates (-0.015%) 700+ Automated trading tools, earning opportunities, and fast trade. Bitfinex 8.4 Zero maker fees for newly listed altcoins 170+ Margin funding, OTC Desk, and paper trading Bitstamp 8.2 Lowest zero fee crypto exchange 100+ Lending and borrowing, Bitstamp institutional solutions, and basic/advanced interfaces.

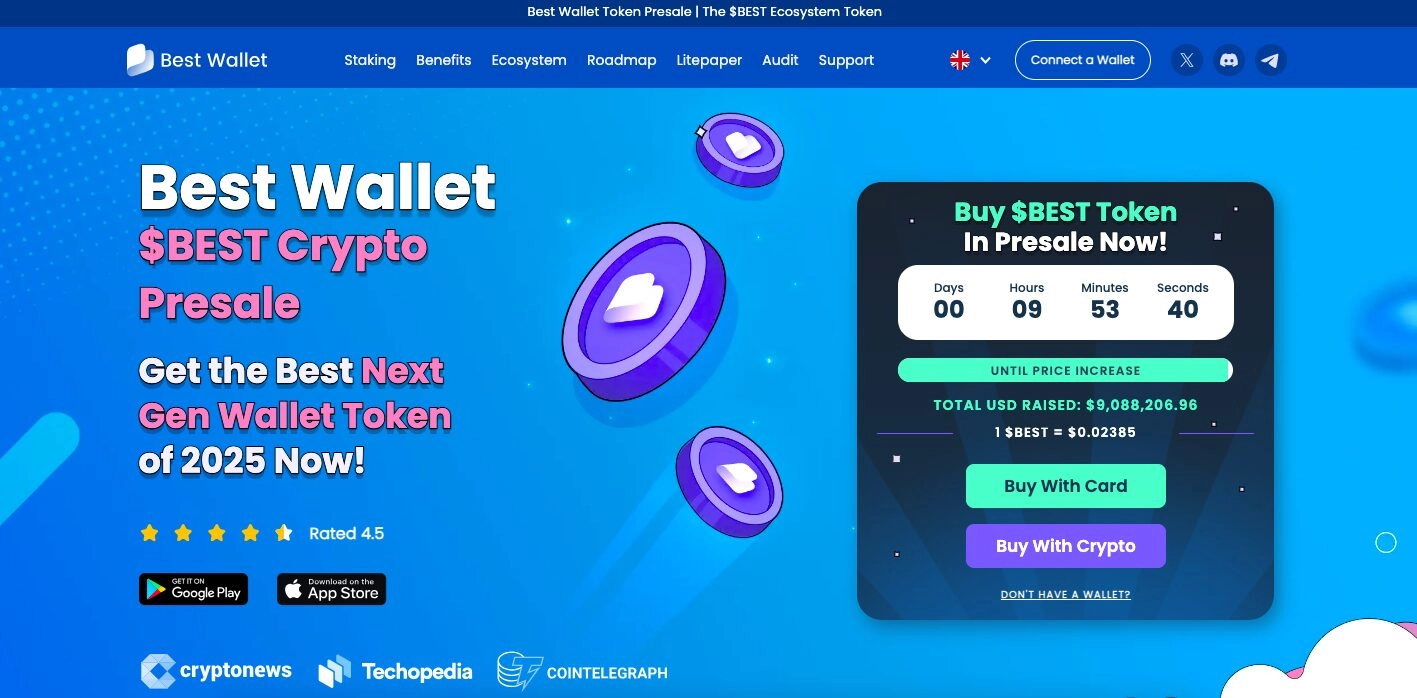

1. Best Wallet

Best Wallet is a decentralized crypto exchange and multi-chain wallet that enables users to buy, sell, and trade Bitcoin and other cryptocurrencies with zero fees. Unlike traditional exchanges, Best Wallet does not charge transaction fees for spot trading, regardless of trading volume or user status.

Best Wallet is currently conducting a presale of its native token, $BEST. Token holders can access additional platform benefits such as early project launches, staking rewards, and governance participation.

Spot Trading Fees Deposit Fees Withdrawal Fees Binance is a top crypto exchange that allows users to buy trade spot pairs, futures contracts, options, and margin contracts, and buy Bitcoin and crypto at low fees. For trading fees, Binance operates a tiered fee structure, charging different fees from regular users to VIP 9 users. Here is the transaction fee structure for various trading options on Binance: Spot Trading Fees Futures Trading Fees Margin Trading Fees Options Trading Fees Deposit Fees: Zero Fees Withdrawal Fees Binance withdrawal fees vary depending on whether you are depositing crypto or fiat currencies. If you are depositing funds, withdrawal fees will depend on the blockchain network and network congestion. Binance Security Binance uses various security measures, such as two-factor authentication, address whitelisting, and SSL encryption , to protect users’ funds and data . They also use MPC (Multi-Party Computation) technology to secure the Web3 Wallet. Binance pros Binance cons Join Binance today to enjoy exclusive perks and claim up to $100 in new user bonuses! MEXC is a leading crypto exchange popular for its high performance, multiple cryptocurrency support, user-friendly interface, and incredibly low fees. MEXC charges the lowest fees for spot, margin, and futures markets. Here’s a breakdown of transaction costs for various trading activities on the MEXC Exchange; Spot Trading Fees MEXC’s spot trading fees are 0.050% for both makers and takers. You can get a 20% discount on trading fees if you use the MX token to pay fees. Futures Trading Fees MEXC charges 0.010% for market makers and 0.040% for takers fees. They also charge 0% for makers and takers on special trading pairs . For discounts, you can either hold MX position above 500 over the last 24 hours for a 50% discount on futures trading costs or transfer MX into your futures account and get 20% off. Deposit Fees: Zero Fees Withdrawal Fees: MEXC does not charge withdrawal fees for some cryptocurrencies, like Tether USDT. However, it does for others, and these fees depend on the Blockchain network and network congestion at the time of the transaction. MEXC Security MEXC secures user funds using robust security features, such as two-factor authentication, cold wallet storage (over $500 million in cold storage), multi-sig authorizations, address whitelisting , and regular security audits. MEXC Pros MEXC Cons Bybit is a leading zero fee exchange that offers traders various services for cryptocurrency trading in one place. On Bybit, Users can trade crypto in the spot, margin, futures, and options markets and explore various decentralized applications and Web3 projects through the in-app Web3 Wallet. Bybit has a tiered fee structure for cryptocurrency trading services. Here’s a rundown of the fee structure on Bybit. Spot Trading Fees Perpetuals and Futures Trading Fees Options Trading Fees Deposit Fees: Zero Fees Withdrawal Fees Withdrawal fees on Bybit vary depending on the Blockchain network and network congestion. You can always check the withdrawal fees in real time to determine how much you need to pay. Bybit Security Bybit employs security features like withdrawal whitelists, 2FA, anti-phishing code, fund password, and multi-signature (multi-sig) technology to ensure the safety of users’ accounts. Bybit Pros Bybit Cons Join Bybit today to access exclusive trading benefits and claim up to $30,000 in new user bonuses! Coinbase is the largest cryptocurrency exchange in the United States by trading volume. The low fees of the crypto exchange facilitate the buying, selling, converting, and storing of various cryptocurrencies, making it accessible to novice and experienced traders. When it comes to trading fees, Coinbase Exchange also uses a maker-and-taker fees model to calculate trading costs. Here are details of the various transaction fees on Coinbase Exchange. Spot Trading Fees Coinbase charges 0.4% for makers and 0.6% for takers. You can get discounts on trading fees up to 0.000% makers and 0.050% takers with a higher 30-day trading volume. Deposit Trading Fees Direct crypto deposits on Coinbase are free. For fiat deposits, fees start at; Withdrawal Trading Fees Traders who prefer zero fee trading on Coinbase can use Coinbase One. It is a subscription product allowing users to trade for $29.99 a month without attracting fees. Coinbase Security Coinbase uses advanced security features, such as two-factor authentication, cold storage for 98% of user assets, biometric verification, data encryption (AES-256 encryption and TLS), and insurance for hot wallets and digital assets against theft. Coinbase Pros Coinbase Cons Kraken is one of the best alternative exchanges to Coinbase for crypto traders who need a reliable exchange in the United States. The exchange offers a platform for users to do more than buy, sell, and swap cryptocurrency assets. The Kraken fee structure differs between the standard Kraken platform and Kraken Pro. Here’s how the fees are charged; Standard Kraken Trading Fees Kraken Pro Trading Fees Kraken Pro uses a maker and taker fees model, and the trading fees decrease as your trading volume increases. Deposit Fees Direct crypto and fiat currency deposits are free on Kraken. Withdrawal Fees For fiat withdrawals, fees range from $0 to $35, depending on the currency and payment method used. For crypto withdrawals, transaction costs depend on the cryptocurrency and network conditions. Kraken Security 2FA, email confirmation, withdrawal confirmations, customizable API keys, PGP encrypted emails, real-time platform monitoring, account timeout, session monitoring, global time lock, and SSL encryption. Kraken Pros Kraken Cons KuCoin is a top zero-fee crypto exchange popularly known as the “people’s exchange” due to its extensive service offering, user-friendliness, and low trading fees. KuCoin supports over 700 cryptocurrencies and 1,300+ trading pairs, making it the ideal exchange for users who want to buy Bitcoin and crypto without incurring high fees. Here’s an overview of KuCoin Exchange fees. Spot Trading Fees Futures Trading Fees KCS discounts do not apply to futures contracts. Deposit Fees Zero fees for direct crypto deposits and most fiat currencies. However, KuCoin charges a fee for EUR deposits, usually around EUR 1, depending on the withdrawal amount. Withdrawal Fees Withdrawal fees for crypto vary, depending on the token and the Blockchain network. KuCoin Security KuCoin employs bank-grade security measures and other robust features to protect user funds. The security systems include 2FA, real reserves backing user assets, and a risk control system (account verification and risk identification). KuCoin Pros KuCoin Cons BitFinex is a low-cost crypto exchange that offers traders the option of exchange trading, margin trading, over-the-counter markets, and derivatives trading. The platform also provides a customizable interface feature that allows you to personalize your workstation. While Bitfinex might be complicated for new beginners due to extensive product offerings and features, the platform offers incredibly low fees, making it an attractive choice for traders. Bitfinex fees are; Spot Trading Fees 0.100% maker fees and 0.200% taker fees. Derivatives Trading Fees 0.0200% maker fees and 0.0650% taker fees. Bitfinex offers discounts to UNUS SED LEO (native token) holders, 0.0200% for market makers and 0.0650% for takers. Deposit Fees Crypto deposits are free on Bitfinex. However, deposits via bank transfer cost 0.1% (minimum fee of $20). Withdrawal Fees Bitfinex withdrawal fees also depend on the crypto and the blockchain networks. For instance, the average fee for Bitcoin withdrawal is capped at 0.0004 BTC and 0.01 XRP for Ripple. So, always check the current fees charged at the point of withdrawal. Bitfinex Security Bitfinex ensures the safety of users’ funds by requiring a second verification form for sensitive operations like withdrawals. They also store substantial funds offline, in multi-signature cold wallets, and conduct regular audits to improve security protocols. Bitfinex Pros Bitfinex Cons Bitstamp is a cryptocurrency exchange that offers tools for individual trading and fiat to crypto services for institutions like family offices and hedge funds. Bitstamp offers low/zero trading fees ranging between 0% – 0.04%, making it an ideal choice for traders who are more interested in trading Bitcoin and other known altcoins. Fee Schedule Staking Fees Deposit Fees All cryptocurrency deposits on Bitstamp are free. Withdrawal Fees The exact crypto withdrawal fee on Bitstamp is usually disclosed before you confirm the cryptocurrency withdrawal due to network instability . Bitstamp Security Bitstamp has insurance, uses institutional grade custody solutions from custodian BitGo, and places 98% of user assets in cold storage. Additionally, Bitstamp encourages withdrawal address whitelisting and uses Multi-sig technology to safeguard their hot wallets. Bitstamp Pros Bitstamp Cons The types of fees that apply on cryptocurrency exchanges are trading fees (maker and taker fees), deposit fees, withdrawal fees, and margin/futures fees. For a better understanding, here is a breakdown of how these exchanges charge these fees. Trading fees are charges cryptocurrency exchanges take when traders execute buy or sell orders. Most exchanges charge based on the maker and taker fees model to compensate for the services they offer traders, including trade execution, liquidity, and market access. The difference between maker and taker fees is that market makers place limit orders (orders filled at a future price that the trader sets). This order adds liquidity to the market since it creates opportunities for others to trade. For this reason, they pay lesser fees than takers. On the flip side, takers place market orders that are filled immediately, therefore removing liquidity from the market. This results in higher fees (taker fees) due to the immediacy of their transactions. Deposit fees are charged when traders deposit crypto or fiat to their trading accounts. Exchanges do not charge traders for direct crypto deposits, but users might incur additional fees when depositing fiat currencies. Withdrawal fees on crypto exchanges are charges traders incur when transferring cryptocurrency from one exchange to an external wallet. These fees vary significantly depending on the exchange, the type of cryptocurrency you are withdrawing, the Blockchain network, and network conditions. Margin fees are charges traders pay when they open positions with borrowed funds from a crypto exchange. Meanwhile, futures fees are transaction costs associated with contracts that allow traders to speculate on price movements without owning the underlying asset. The factors to consider while deciding the best no-fee crypto exchanges are features, security, supported cryptocurrencies, ease of use, and liquidity. Security Look for crypto exchanges that undergo regular security audits, use cold storage for assets, withdrawal whitelisting , two factor authentication, and other robust security protocols to safeguard user funds. Supported Cryptocurrencies Ensure the crypto exchange supports a wide range of cryptocurrencies and trading pairs that you wish to trade. Some exchanges have only a few hundred coins, while others have a few thousand; choose one that does not restrict your trading options. Ease Of Use The exchange you opt for should be easy to navigate, with quick registration, accessible trading tools, educational resources, reliable customer support, and demo accounts for you to practice. For instance, MEXC has the fastest registration process, requiring only your email and a MEXC referral code . Always do your own research and compare features, network fees, and security to determine which zero-fee exchange is best for you. Liquidity The crypto market is highly volatile. You want an exchange that fulfills orders at the price you choose without significant slippage. So, Check the exchange’s daily trading volume and the liquidity of the pairs you intend to use. To buy Bitcoin and crypto without fees, use any of our best zero fee crypto exchanges. Most of these platforms, like MEXC and KuCoin, charge zero fees, while others charge as low as 0.10% for regular users. Binance and MEXC are good exchanges to buy Bitcoin and crypto ; they provide 0% fees for spot and futures trading. If you want to compare or learn more about the two exchanges, read this comprehensive Binance review and MEXC review . To minimize exchange fees, you can do any of the following:

2. Binance

3. MEXC

4. Bybit

5. Coinbase

6. Kraken

7. KuCoin

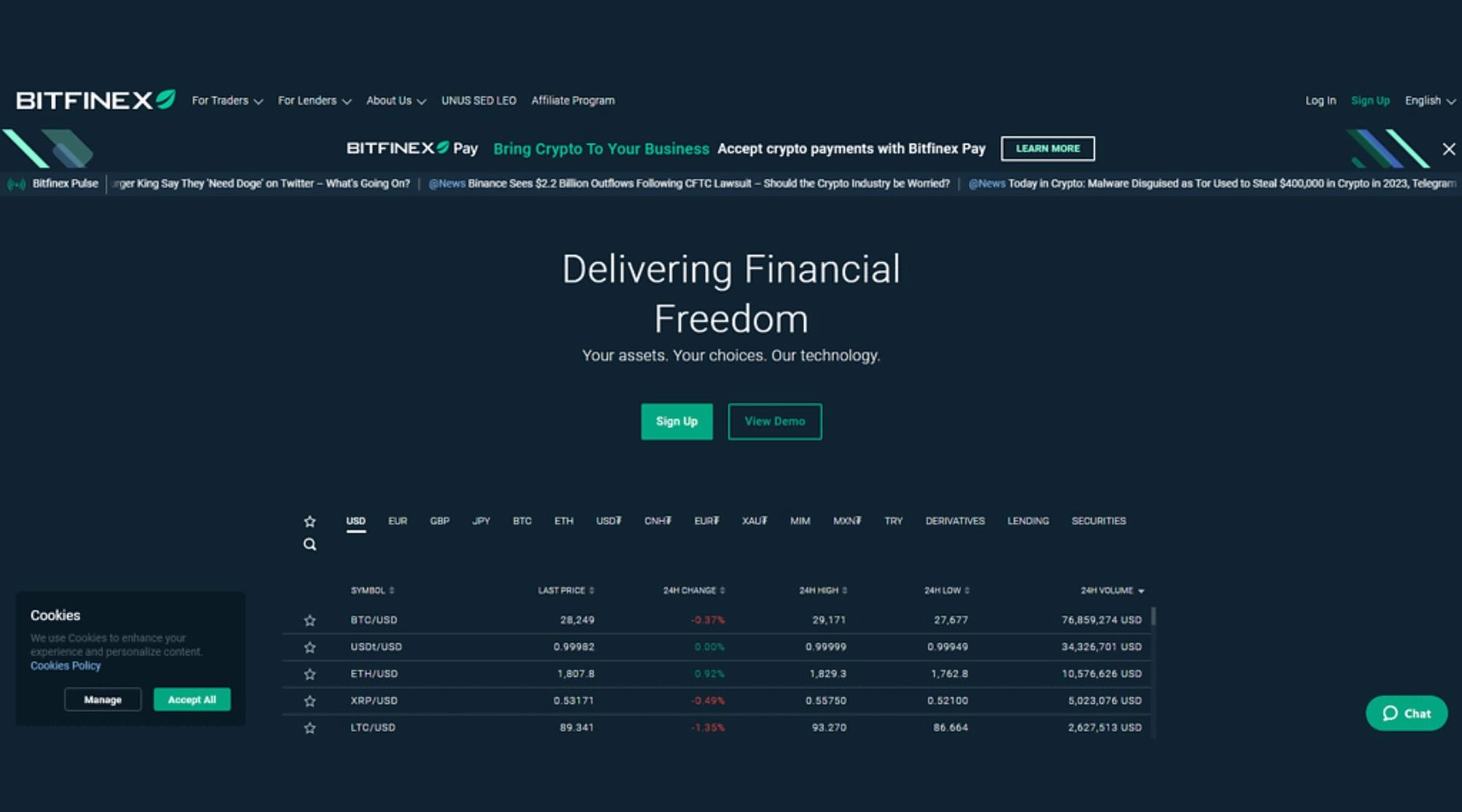

8. Bitfinex

9. Bitstamp

What Types of Fees Apply on Crypto Exchanges?

Trading Fees (Maker & Taker Fees)

What’s the Difference Between Maker and Taker Fees?

Deposit Fees

Withdrawal Fees

Margin/Futures Fees

What are the Criteria to Evaluate When Choosing the Best No-Fee Exchange?

How To Buy Bitcoin & Crypto Without Fees?

How can I Minimize Exchange Fees?