Source: https://www.crypto-news-flash.com/

Source: https://www.crypto-news-flash.com/

Franklin Templeton, a global asset manager, has recently launched its blockchain-based money market fund, FOBXX, on the Ethereum Layer-2 scaling network, Arbitrum. This move comes as tokenised real-world asset (RWA) funds gain increasing attention from investors.

Arbitrum, known for its efficient and scalable infrastructure, now hosts FOBXX, enabling retail investors to access the fund through their digital wallets. Franklin Templeton’s focus on expanding access to this fund underscores the growing demand for tokenised financial products within highly secure blockchain ecosystems.

FOBXX is designed to invest predominantly in U.S. government securities, with a minimum of 99.5% of its assets allocated to these instruments, along with cash and fully collateralised repurchase agreements. This strategic investment approach aims to deliver relatively high returns to both institutional and retail investors.

As of July 31, FOBXX managed approximately US$420 million in assets, positioning it as the second-largest on-chain treasury fund, trailing only the BlackRock USD Institutional Digital Liquidity Fund (BUIDL). BUIDL reached a market cap of US$510.3 million since its launch in March 2024.

.

Advertisement

Related: BlackRock’s RWA Fund on Ethereum Surpasses $500 Million, Achieving 100% Monthly Growth

The fund’s expansion onto the Arbitrum network aligns with Franklin Templeton’s broader strategy of enhancing fund accessibility through secure and resilient blockchain platforms

The launch of FOBXX on Arbitrum follows its initial debut on the Stellar network in 2021 and its subsequent availability on Polygon. This progression underscores Franklin Templeton’s dedication to using blockchain technology to meet investor demands.

The firm’s ongoing collaboration with regulatory bodies, including the SEC, highlights the importance of ensuring these advancements benefit all stakeholders involved. As the tokenised treasury market continues to expand, FOBXX’s presence on Arbitrum marks a significant milestone in the evolution of blockchain-based financial products.

Ripple Fined $125M in Long-Running SEC Case

In a major development, a federal judge has ordered Ripple Labs to pay a $125 million civil penalty as part of its ongoing legal battle with the U.S. Securities and Exchange Commission (SEC). This penalty comes after the court found that Ripple’s institutional sales of XRP violated federal securities laws.

The lawsuit, initiated by the SEC in December 2020, accused Ripple of conducting an unregistered securities offering worth US$1.3 billion through the sale of XRP tokens. The legal proceedings saw a significant moment in July 2023, when Judge Analisa Torres ruled that while Ripple’s institutional sales did breach securities regulations, their programmatic sales to retail investors did not. This nuanced decision has been a point of contention throughout the case.

Despite the substantial US$125 million fine, it is far less than the SEC’s initial demand of nearly US$2 billion. Additionally, Judge Torres has imposed an injunction preventing Ripple from any future violations of federal securities laws. This injunction means Ripple must adhere strictly to regulatory requirements if they plan to engage in similar activities in the future.

As a result of this less than requested US$2B penalty, XRP surged as high as 30% at one stage, before retracing to a daily gain of 18%.

Source: CoinMarketCap

Source: CoinMarketCap

Ripple CEO Brad Garlinghouse expressed optimism about resolving the remaining legal issues soon, indicating that the company is eager to move past this legal hurdle and continue its operations within the bounds of U.S. law.

This ruling marks a significant moment in the ongoing dialogue about how cryptocurrencies are regulated and could set a precedent for how other crypto-related cases might be handled in the future.

Down but Not Out – A Deep Dive into TA This Week.

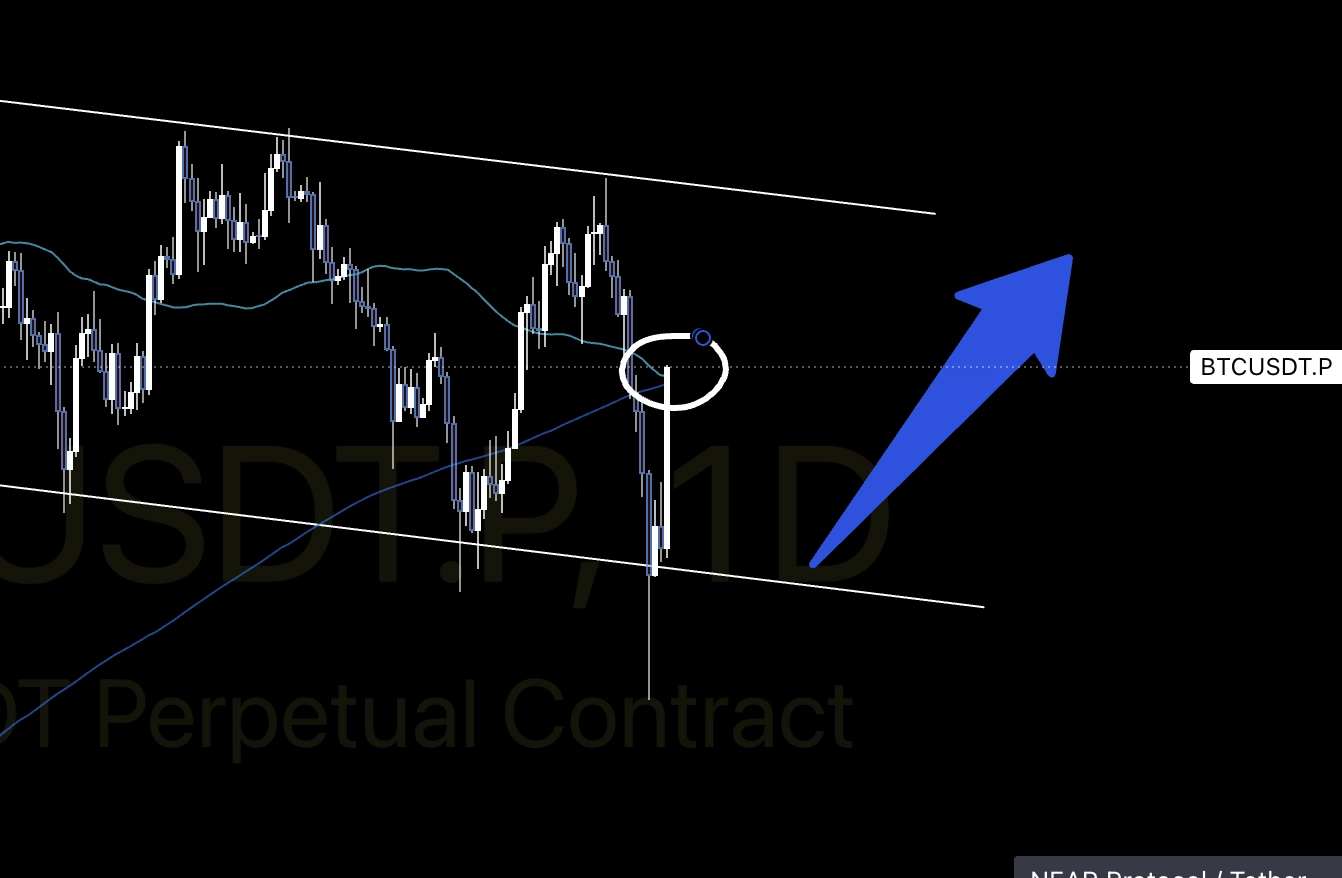

Bitcoin’s recent dramatic drop from the critical $64,000 USD level, a price point we previously identified as crucial, has sparked widespread concern among investors. However, this decline, though severe, was temporary. To understand the forces at play, we must consider the broader economic landscape and the specific events that contributed to this pullback.

Source Tradingview

Source Tradingview

The Bigger Picture: Economic Factors at Play

The cryptocurrency market does not operate in isolation. External economic factors often have a significant impact on Bitcoin’s price movements. Recently, fears of a major recession have gripped global markets, exacerbated by a near-collapse in the Japanese stock market.

The Nikkei’s sudden decline sent shockwaves through financial markets, triggering a flight to safety among investors, which often means pulling out of riskier assets like cryptocurrencies.

Bitcoin, as the leading digital asset, felt the brunt of this market-wide risk aversion. The price fell sharply, breaking through the $50,000 level, and testing the historically significant $48,000 USD mark as you can see by Google’s search history below. This level has been a pivotal support in Bitcoin’s history, and its retest was inevitable under the circumstances.

Source: Google

Source: Google

Source: Tradingview

Source: Tradingview

Let’s see how this unfolds over the next week! Stay tuned.