Five days ago, Coinbase announced plans to remove wrapped bitcoin (WBTC) from its platform on Dec. 19, 2024. In the days following the announcement, the WBTC supply has contracted.

Wrapped Bitcoin’s Supply Drops by 5,844 Coins in 8 Days

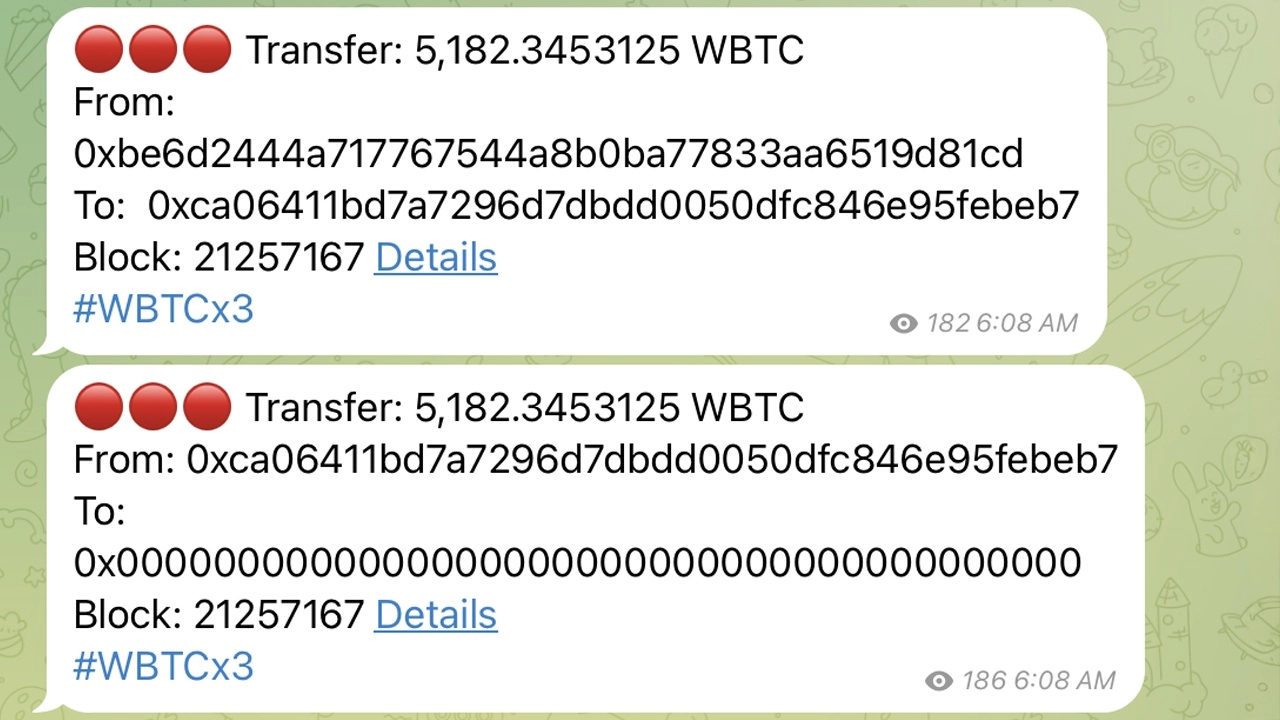

On Nov. 16, the WBTC supply on Ethereum was recorded at 146,734 coins. Fast forward to today, Nov. 24, and that figure has dropped to 140,890 WBTC—a reduction of 5,844 coins. Adding to the intrigue, btcparser.com’s Ethereum Transaction Monitor flagged a 5,182.34 WBTC burn transaction. Meanwhile, Ashley, known as @mrsthreshold on X, highlighted the burn in a post. She stated:

Huge [wrapped bitcoin] burn pending.

“It’s a rare occurrence to see such large amounts of wrapped bitcoins (WBTC) moving on the Ethereum chain,” btcparser.com’s operator told Bitcoin.com News. “Interestingly, this time it appears that they were burned.”

Btcparser.com’s Ethereum Transaction Monitor.

Btcparser.com’s Ethereum Transaction Monitor.

WBTC has been in the spotlight recently, sparking debate after Bitgo announced a joint venture with Bit Global, a company tied to Justin Sun. The move stirred unease among crypto enthusiasts, but Bitgo’s CEO was quick to dismiss the worries. “I’d encourage you to meet with the Bit Global team to hear how the custody will be secured along with Bitgo,” Mike Belshe told the Sky community, formerly Makerdao.

Amid the controversial buzz, Coinbase rolled out its own wrapped bitcoin derivative, and its adoption has been climbing rapidly. Adding fuel to the fire, on Nov. 19, the San Francisco-based crypto exchange announced plans to remove WBTC from its offerings. “Based on our most recent review, Coinbase will suspend trading for WBTC (WBTC) on December 19, 2024, on or around 12pm ET,” Coinbase relayed to its social media followers on X.

The latest burn, calculated using BTC exchange rates at 11:50 a.m. Eastern Time on Sunday, translates to over half a billion dollars—roughly $500,125,712 in USD value. Wrapped bitcoin (WBTC) and Coinbase’s cbBTC aren’t alone in the wrapped bitcoin space, facing stiff competition from other options like BTCB, a wrapped bitcoin on the BNB Chain.

Alongside WBTC, BTCB, and cbBTC, Threshold Network’s tBTC is a contender in the BTC wrapper arena. This option provides a decentralized, permissionless bridge between Bitcoin and Ethereum. As the BTC derivatives token market evolves, the rivalry between newer derivatives and established giants like WBTC continues to shape the competition in the crypto sector. Big onchain burns like this often spark curiosity and debate, as they can signal shifts in liquidity or underlying sentiment about the token’s future.